Executive Summary

Current Themes:

📊 Supply-Demand Imbalances Spur Treasuries Selloff

There is a massive supply of Treasuries ($12Tn) coming to market and there is not enough demand to support it. Yields have been climbing to compensate.

IMPACT: Higher rates for longer → bad for equities and long bonds

📈😬 Rising Inflation Erodes Consumer Spending Power

Higher prices for necessities eroding real incomes. Consumers spending down savings and trading down to lower priced goods, hurting discretionary purchases.

IMPACT: Lower consumer spending → bad for consumer cyclicals

🏡🔨 Housing Affordability Deteriorates from Higher Rates

Affordability of homes is deteriorating due to rising mortgage rates. Banks hesitant to extend home loans. The result is that people are staying in their homes for longer (restricting supply), and demand is falling.

IMPACT: Persistently higher mortgage rates → bad for housing demand

😬 Stocks Face Growth Headwinds

The equity risk premium is compressing as rates rise, signaling lower risk/return for stocks relative to treasuries. Earnings optimism seems unrealistic given risks.

IMPACT: Stocks are not priced well relative to risk → bad for equities

Recommendations:

Consider defensive & late-cycle sectors like energy ⚡️ and 🏭 industrials while being cautious with consumer cyclicals 🔄.

Increase allocations to cash and short-term treasuries. Interest rates are rising and the risk-free interest rate is high. Take the risk-free money.

Detailed Article

📊 Treasury Supply-Demand Imbalances Drive Yields Higher

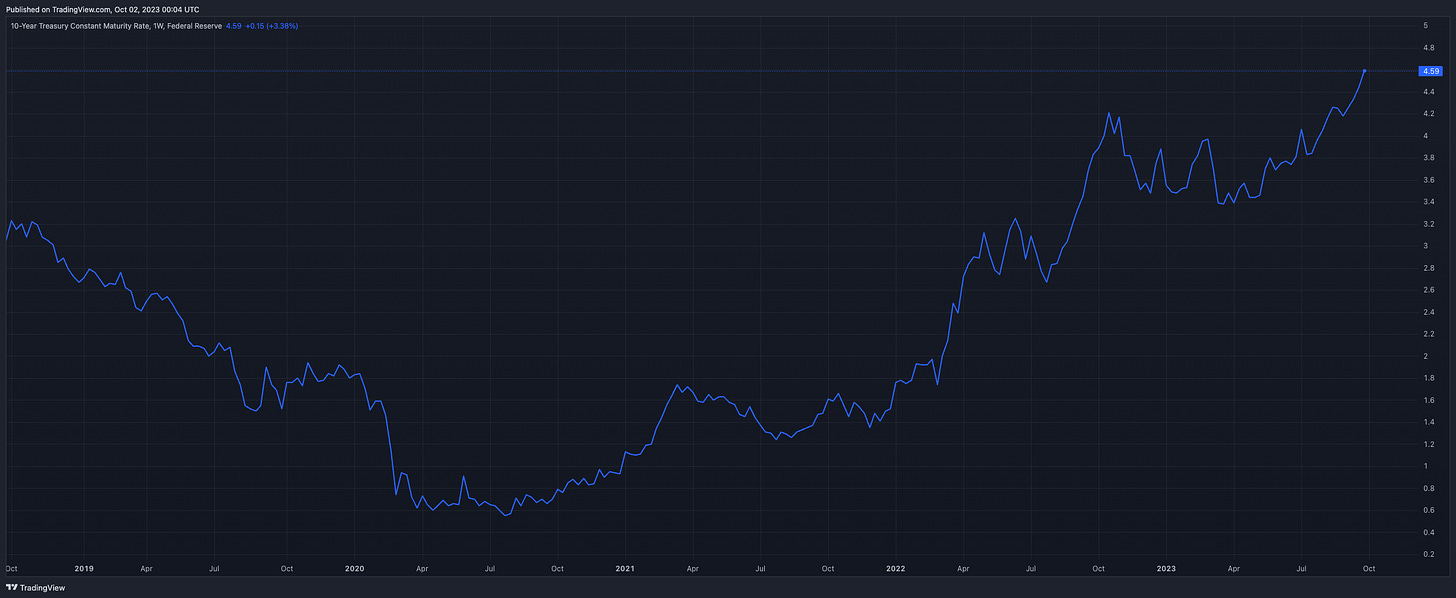

The 10-year Treasury yield hit its highest level since 2007, surpassing 4.5% in late September (Mackenzie et al., 2023). This selloff comes from a significant supply-demand imbalance in the Treasury market.

On the supply side, around $12 trillion in Treasuries need to be issued or refinanced over the next year. This includes refinancing about $10 trillion of existing Treasuries at higher rates plus $2 trillion in new issuance. Higher yields will increase the government's interest costs by over $500 billion. On the demand side, it's unclear who will step in as marginal buyers. The stronger dollar (~106 today vs. 99 in July) is creating sell pressure from foreign governments (need to sell Treasuries for dollars to pay USD debts).

$12 Trillion of Treasuries need to be issued / refinanced to support the US government’s widening budget gap

Bond yields have been rebalancing due to 1) ~$10Tn of treasuries that need to be refinanced in 12 months and 2) ~$2Tn of expected new issuance in Q3 and Q4. Auctions of three- and 10-year notes over the past few days drew the highest yields since 2007.

The refinancing of existing Treasuries will likely be at higher rates, resulting in over $500 billion of interest service cost

Central banks are committed to raising policy rates to tackle high inflation

Market yields have been increasing due to expectations of the Fed maintaining its policy rate (5.33% as of Aug-23) and an increase in government debt issuance.

Interest rates are expected to rise above 5% in 2023 before modest cuts in 2024. Traders on Kalshi are betting that rates will stay above 5% through the July 2024.

The treasury market is at risk of "bear steepening" (a situation where long-term interest rates rise faster than short-term rates).

The TLT (long bond fund) has crashed in price last week (as yields increase, prices decrease)

😬 Rising Inflation Erodes Consumer Spending Power

Consumers are growing more pessimistic about the economy due to factors like higher food and gas prices. Consumers are spending down excess savings and trading down to lower priced goods, pressuring discretionary purchases.

🛒 Prices for necessities are still much higher than pre-pandemic levels.

Households are spending an extra $734 per month on the same goods compared to two years ago according to Mark Zandi, chief economist at Moody's Analytics (Niquette et al., 2023).

The cost of food increased 0.8% in August, bringing the food-at-home index to 13.5% above its year-ago level (Niquette et al., 2023).

Electricity prices rose 1.5% in August while natural gas service jumped 3.5% (Niquette et al., 2023).

A surge in crude oil prices (above $95 a barrel) is hitting consumers especially hard at the pump.

The American consumer is strained from all sides. Millions of Americans will start getting student-loan bills again this month because the pandemic freeze has expired. The resumption of payments could cut another 0.2-0.3% from annualized GDP growth in the fourth quarter.

Consumers are spending down excess savings and trading down to value price points, putting pressure on discretionary purchases.

Consumer spending rose 0.8% annualized in Q2, down from 1.7% previously estimated. This was the weakest pace in over a year (Saraiva, 2023).

Cautious consumer behavior continues, especially for lower income consumers disproportionately impacted by reduced government aid and rising living costs.

Retailers continue to cite inventory destocking, but most do not anticipate a strong holiday season. Continued promotions and weakness in discretionary categories persists. Organized retail crime and theft is also becoming a major issue.

Travel and experiences remain an area of relative consumer strength as restrictions have eased. Airline executives highlight strong forward bookings, particularly business and premium demand.

🏡🔨 Housing Affordability Deteriorates from Higher Rates

Borrowing costs have put the housing recovery at risk and have already started to impact prices and rents. Existing home listings are at 40-year lows, supporting the view that homeowners are staying in their homes and not selling. Affordability has also deteriorated due to rising mortgage rates, and banks are hesitant to extend credit to prospective home buyers. The result has been decreasing median home sale prices in the US.

The housing market is influenced by demand for shelter, supply of shelter, affordability of the US housing market, and availability of mortgage credit. Let's break this down to those four components:

Demand for shelter

Existing-home sales decreased by 0.7% in Aug-23 to a seasonally adjusted annual rate of 4.04 million (down 15.3% from one year ago)

Supply of shelter

The Federal Reserve's interest rate increases have driven up home loan costs and have discouraged owners from selling their houses, exacerbating an inventory shortage in the housing market and helping to keep prices higher.

This is reflected in the fact that new home sales are only ~20% of total sales, while existing home listings are at 40 year lows.

Affordability

Affordability has deteriorated due to rising mortgage rates (+7%)

Availability of mortgage credit

Banks are reluctant to extend credit to home buyers due to the March banking crisis and uncertainty around home collateral values

Result: Housing market indicators like house prices and rents have slowed sharply amid rising interest rates. The housing market weakening under pressure of 7%+ mortgage rates. Median home prices have held steady (~$436,700) but are still down ~26% YoY. If affordability doesn't improve and there is a harder landing in the market, home prices could come down further.

📈😬 Stocks Face Growth Headwinds

Higher interest rates and the attractiveness of bonds are putting pressure on equities. The spread between expected returns on the S&P index relative to bond yields is compressing, suggesting the risk premium is shrinking (e.g. you are not getting paid enough to take more risk - see chart above). This suggests that stock valuations are still elevated and pricing in strong earnings growth which may not materialize.

Consumers are growing more pessimistic about the economy despite stable inflation expectations and a strong job market (Niquette et al., 2023). Factors like slowing consumer spend, rising delinquencies, higher gas prices, and housing weakening pose risks.

Consumer discretionary stocks are up 26% in 2023 vs. 13% for the S&P 500, but now seeing weakness signs like performance breakdowns (Wilson, 2023).

44% of consumer discretionary stocks are trading below their 200-day moving average, another negative signal per Wilson (Wilson, 2023).

Stocks are pricing in strong earnings growth which may not materialize

Stocks price in 12% earnings growth in 2023 and 13% growth in 2025 despite risks (Elliott)

Stock valuations of around 20x P/E imply highly elevated earnings growth ahead (Elliott)

Consensus forecasts for 2024 S&P 500 profits near $250 per share seem optimistic given potential growth, policy and valuation headwinds (Morgan Stanley)

Significant risks could upend optimistic scenarios

Rapid Fed tightening may cause delayed downturn as full impacts manifest

Other headwinds include China struggles, European dysfunction, and dollar strength. Multiple other signs, such as credit tightening, increased bankruptcies, and a decrease in job openings are downside risks

Wilson recommends investors pivot to defensive, late-cycle areas like energy and industrials and avoid consumer cyclicals (Wilson, 2023)

Bibliography

Chen, J. (2023, September 24). China Developers Drop Most in 9 Months on Evergrande Woes. Bloomberg. https://www.bloomberg.com/news/articles/2023-09-24/china-developers-drop-most-in-nine-months-on-evergrande-woes

Elliott, B., Larsen, A.S. & Bennington, A. (2023). The Deep Dive: Part 11 - Is a Recession Priced In? [PDF document]. Retrieved from Real Vision Website: https://www.realvision.com

Kmetz, A., Louie, S., & Mondragon, J. (2023). Where is shelter inflation headed? FRBSF Economic Letter, 2023-19. https://www.frbsf.org/economic-research/publications/economic-letter/2023/august/where-is-shelter-inflation-headed

Mackenzie, M., Xie, Y., & McCormick, L. C. (2023, September 23). Bond Market Faces Quandary After Fed Signals It’s Almost Done. Bloomberg. https://www.bloomberg.com/news/articles/2023-09-23/bond-market-faces-quandary-after-fed-signals-it-s-almost-done

Miletti, A. (2023). Getting Ahead of Recovery: Equities from 10,000 Feet Up. Allspring Global Investments.

Morgan Stanley Wealth Management. (2023). Midyear Outlook 2023: Decoding Diverse Signals.

Niquette, M., Dillard, J., & Sasso, M. (2023, September 24). The Fed Is Curbing Inflation, But Consumers Say They’re Still Paying Too Much. Bloomberg. https://www.bloomberg.com/news/articles/2023-09-24/fed-s-inflation-fight-not-matching-reality-of-high-prices-for-us-consumers

Samadhiya, R., Browning Platt, C., Hartnett, M., Maras, M., & Irigoyen, C. (2023). BofA Global Proprietary Signals: The Weight of the Evidence. BofA Securities.

Wilson, M. (2023, September 25). Morgan Stanley’s Wilson Sees Risks Rising for US Consumer Stocks. Bloomberg. https://www.bloomberg.com/news/articles/2023-09-25/morgan-stanley-s-wilson-sees-risks-rising-for-us-consumer-stocks

Octahedron Capital Management, L..P. (2023). A Few Things We Learned: 2023 - July – August - September.

Saraiva, A. (2023, September 28). US consumer spending rose at weakest pace in a year last quarter. Bloomberg. https://www.bloomberg.com/news/articles/2023-09-28/us-consumer-spending-rose-at-weakest-pace-in-a-year-last-quarter

Gledhill, A., & Mackenzie, M. (2023, September 30). Once unthinkable bond yields now the new normal for markets. Bloomberg. https://www.bloomberg.com/news/articles/2023-09-30/once-unthinkable-bond-yields-now-the-new-normal-for-markets

DISCLAIMER

Opinions expressed are solely my own and do not express the views or opinions of my employer.

NO INVESTMENT ADVICE

This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content on the site before making any decisions based on such information or other content.

INVESTMENT RISKS