Macro View on the Economy

Views on the dollar, commodities, and US equity markets

Why should you read this?

You don’t need to be a finance practitioner to understand there is a disconnect between financial markets and economic reality. The talking heads in the financial media use inside baseball jargon to confuse people. This is intentional. It diverts attention away from the simple truth that this is an unprecedented time in history, nobody has a crystal ball, and everyone is figuring it out as they go. I have a varied background (M&A, private equity, corporate strategy, and restructuring) which allows me to see the financial world through a different lens. My goal is to present the facts, give you some data to work with, and communicate my insights in plain english (not financial jargon) so you can reach your own conclusions.

I have included a summary of key points in the executive summary below (for those who want the TL;DR version of the article). Please consider subscribing if you find this informative (I promise not to spam you with articles).

Executive Summary: How do you trade in this environment?

I have summarized the key points of the article below.

Debt monetization (“money printing”): The Federal Reserve (“Fed”) accumulated more Treasuries within six weeks in early 2020 than the entire foreign sector accumulated over the past six years. This “new” money has made its way into the financial system (banks are well capitalized) and has supported asset prices (excess liquidity has a strong correlation to higher stock prices due to multiple expansion). In other words, expanding deficits and debt monetization are good for stocks and the broader economy but they are not sustainable in the long run.

COVID-19 case count: We have seen a resurgence in US COVID-19 cases led by southern and western states (possibly due to premature re-opening plans and procedures). The 7-day moving average of COVID-19 deaths is back above 800 per day. Clearly these trends are not heading in the right direction and it should cause some concern for investors.

Employment statistics: Continuing jobless claims have started to level off and have been declining for the past 6 weeks. However, we have had 17 straight weeks of initial claims levels above the 1 million mark. Permanent layoffs have also risen by 1.6 million in just four months. This is especially concerning in light of the looming expiration of supplementary unemployment benefits ($600/wk) in July 2020. If there is a retrenchment of fiscal support and COVID-19 case count continues to rise, we may see a pullback in the market in Q3 or Q4 (although this is not my base case)

Dollar weakness: The dollar started the year on very strong footing. However, the federal reserve decided to cut rates in response to the crisis making the US market less competitive for investment dollars. More recently, the Fed also provided dollar liquidity currency swap lines to foreign central banks allowing them to access dollars as required when there is a shortage. In other words, the factors that were pushing the dollar up historically have reversed their trends. The combination of all these factors have made left tail events (dollar devaluation) more likely than right tail events (dollar appreciation). The most likely scenario (in my mind) is that the US will continue to struggle with the virus while Europe and Asia will recover faster. This in combination with more debt monetization (“money printing”) in the US will cause the dollar to decline relative to other currencies (although the time horizon for this is still unknown).

Inflation expectations: According to Lyn Alden, the US lost ~$7 trillion of cumulative net worth in Q1 2020 (as compared to $11 trillion in the 2008 recession). This is an inherently deflationary shock as monetary value is destroyed via personal deleveraging and business insolvency. To combat these deflationary forces, the US Federal Reserve has printed $3 trillion dollars (inflationary force) and injected those dollars into the economy to prop up asset prices and further strengthen bank balance sheets. US break-even rates (the difference in yield between inflation-protected securities and nominal debt of the same maturity) have been trending upward since March 2020 (10-year break-even rate is 1.48% as of July 21, 2020). Positive break-even rates suggest that traders are betting the economy may face inflation (rather than deflation) in the near future.

Conclusion: If the dollar strengthens and deflation takes hold it may cause a broad sell-off in equities. If the dollar continues to weaken (and the fed / treasury step in to support markets with more monetary and fiscal stimulus) then stocks may rally and fund managers may rotate away from growth stocks (tech) into value stocks (industrial, financial). Commodities (steel / copper) and precious metals (gold / silver) may also do well in this environment. Gold and silver have already started to outperform relative to the S&P.

The prelude: rising federal deficits and money printing

I would like to lay some foundations first. Our government can fund itself through a combination of taxing / borrowing from the domestic market (federal taxes and borrowing - left quadrant), borrowing money from foreign lenders (sale of treasuries abroad - middle quadrant), and printing money (central bank buying treasuries with completely new dollars - far right quadrant).

We generally spend more money than we collect in taxes in a given year, so we have increasingly turned to borrowing money and running persistent deficits to fund our government spending. Our fiscal deficit (calculated as the difference between government revenues and spending) was already expanding prior to the COVID-19 crisis in part due to rising entitlement spending (government programs like social security where obligations increase due to an aging population) and large tax cuts (in 2017) that were not offset by government spending reductions. In 2019, our deficit was $984 billion (equal to 4.6% of GDP, or the value of all goods and services produced in the United States). The Congressional Budget Office projects that the deficit could rise to $3.7 trillion, or 17.9% of projected GDP (perhaps more if additional stimulus measures are approved). This is very large even by historical standards. Deficits over the last fifty years have averaged ~3% of GDP while the largest deficit ever recorded was 9.8% of GDP (FY2009).

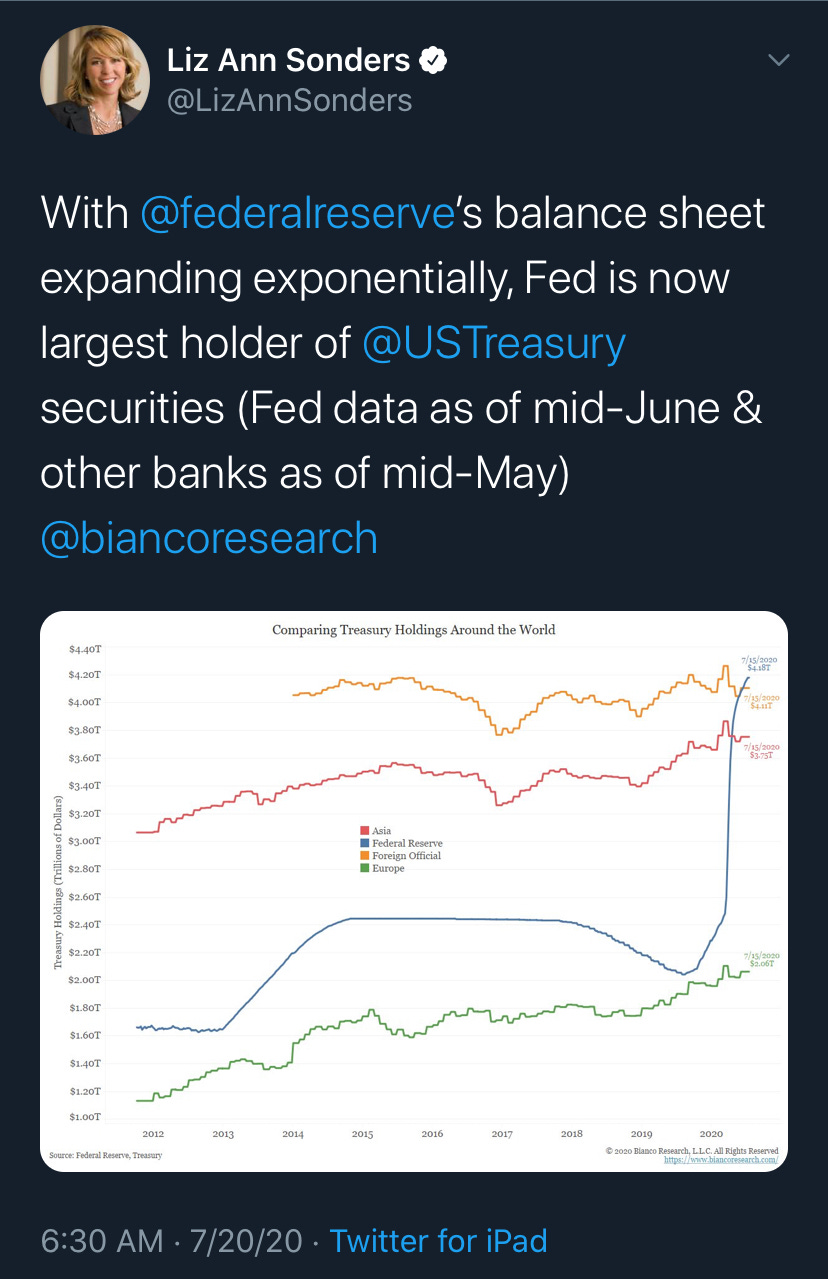

So who is buying all our debt? We are (the US Federal Reserve). The Fed accumulated more Treasuries within six weeks earlier this year than the entire foreign sector accumulated over the past six years. The federal reserve is now the largest holder of treasuries with $4.18 trillion on its balance sheet (below - as of 7/15/20).

Due to the strong dollar environment and weak foreign demand for treasuries, the U.S. has financed its federal deficits through debt monetization. Monetizing debt is a process whereby the Treasury issues government bonds (through treasury auctions to US commercial banks) and the Fed (blue line above) buys Treasury and corporate debt in the open market, leaving the financial system with an increased supply of money. The Fed needs to buy this debt because the private money markets are unwilling or unable to do so in the quantities necessary at desired (lower) yield levels. Where does all this new money go?

This “new” money eventually makes its way to the financial system. Commercial banks absorb some of it (the red and blue lines above represent commercial bank treasury and cash holdings, respectively). As you can see, the S&P 500 (black line above) rallied as commercial bank cash holdings returned to more normalized levels (increased from ~10% to ~16% of total bank assets).

Some of that money also found its way into financial markets. Excess liquidity (red line above) has a strong correlation to higher stock prices (gray line - valuation multiple expansion in the S&P 500). In other words, expanding deficits are good for stocks and the broader economy, but they are not sustainable in the long run.

Current Economic Conditions: COVID-19 cases and unemployment

Lets switch gears and talk about current market conditions. I firmly believe that macro conditions drive policy response (fiscal stimulus and federal asset purchases) and policy response drives markets either higher or lower. I am tracking COVID-19 case count and unemployment statistics because I think they will drive policy response (and hence the direction of equity markets).

Lets start with COVID-19 case statistics. We have seen a resurgence in cases led by southern and western states (possibly due to premature re-opening plans and procedures). Our average daily case count is ~64k with ~38.5k coming from southern states and ~16k coming from western states. The US reported 546 new coronavirus deaths as of July 20th, bringing the total to 143,834 deaths. This also pushed the 7-day moving average back above 800 deaths per day. Clearly these trends are not heading in the right direction and it should cause some concern for investors.

Now lets pivot to unemployment statistics. Initial jobless claims show the number of people seeking unemployment benefits for the first time (red line below) whereas continuing claims (blue line below) paint a clearer picture of how unemployment is persisting over time. Continuing jobless claims have started to level off and have been declining for the past 6 weeks. However, we have had 17 straight weeks of initial claims levels above the 1 million mark. Permanent layoffs have also risen by 1.6 million in just four months. This is especially concerning in light of the looming expiration of unemployment insurance ($600 / week) in July 2020. Expanded unemployment insurance helps insulate lower income households from the direct financial hardship of job losses and helps the broader economy by deferring or eliminating loan defaults that would have otherwise been unavoidable (deflationary shock). If there is a retrenchment of fiscal support and COVID-19 case count continues to rise, we may see a pullback in the market in Q3 or Q4 of this year (although this is not my base case).

The increase in new cases and stagnant employment growth is having an impact on financial markets. Bloomberg has an amazing COVID-19 dashboard (screenshot below) that summarizes high-frequency, alternative and market-based data to track the status of the economic recovery. The key takeaways are that travel (both by plane and by public transport) is down and consumer sentiment is shifting more negative. This may translate into widespread business closures and permanent job losses if Congress is unable to come to a consensus on a new stimulus bill.

Macro forces: Dollar weakness

Now lets turn our attention to the dollar. Tracking the relative strength of the dollar is important for an number of reasons including:

The dollar serves as global reserve currency and helps facilitate global transactions. It is also a “safe haven” asset that generally strengthens in chaotic times.

The majority of global trade is invoiced in US dollars. In fact, the share of US dollar trade invoicing across countries far exceeds their share of trade with the US. Many commodities are priced in dollars, and countries hold dollar reserves to pay for goods. Emerging market economies are particularly dependent on the dollar due to credit-intensive supply chains (banks extend trade credit in dollars). A strong dollar may reduce demand for exports from emerging market economies.

Foreigners own ~$40 trillion of US assets and there is ~$13 trillion of US dollar denominated debt outside of the United States. The relative strength or weakness of the dollar has a large impact on financial markets outside the US. When there is a liquidity crunch (in the form of a dollar shortage), foreign governments may sell U.S. assets or treasuries to get access to dollars (net negative impact on U.S. financial markets).

What has happened to the US dollar recently? The dollar started the year on very strong footing. There was a five year period (see dollar index chart below) where the US markets substantially outperformed the rest of the world. The US federal reserve went on a rate hiking cycle while the rest of the world had negative yielding debt. Europe and China were also putting upward pressure on the dollar (due to European fragmentation risk and China trade war concerns). This coupled with strong earnings growth for US corporate entities (led my mega-cap tech stocks) made the US market more attractive for investment.

The COVID-19 crisis changed some of these dynamics. On one hand, the pandemic actually raised the dollar’s value quite substantially during the stock market crash in March 2020. The 10-year treasury benchmark yield jumped by 55 basis points (prices of treasuries declined) over the span of eight trading days and funds lost billions on speculative treasury bond and treasury bond futures positions. There was a liquidity crunch in the market which caused a surge in demand for dollars (emerging market economies needed dollars to make payments on US denominated debt; trade finance came to a grinding halt; hedge funds were getting margin calls by banks) driving the dollar higher relative to other currencies.

On the other hand, the federal reserve decided to cut rates in response to the crisis making the US market less competitive for investment dollars. More recently, the Fed also provided dollar liquidity currency swap lines to foreign central banks allowing them to access dollars as required. In other words, the factors that were pushing the dollar upward have since reversed. In addition to this, Europe has approved a recovery fund plan that would include grants for businesses in countries that have struggled (reducing risk of massive defaults or fragmentation) while the US / China trade war has subsided (or at least there is limited desire to push the trade war further prior to the election).

The combination of all these factors have made left tail events (dollar devaluation) more likely than right tail events (dollar appreciation).

Now the question is: What if global growth picks up and the dollar devalues?

A second wave of coronavirus may expand beyond the US. However hospitalizations may not rise to the same degree (a younger cohort is getting infected resulting in fewer deaths). The bigger factor is that Europe and Asia have done a better job at containing the virus than the United States. This may put further downward pressure on the dollar in the near-term.

The most likely scenario (in my mind) is that the US will continue to struggle with the virus while Europe and Asia recover faster. This coupled with more debt monetization (“money printing”) in the US will cause the dollar to devalue relative to other currencies (although time horizon is still an open question).

Macro forces: rising inflation (reflation)

According to Lyn Alden, the US has lost ~$7 trillion of cumulative net worth in Q1 2020 (as compared to $11 trillion of lost value in the full 2008 recession). This is an inherently deflationary shock as monetary value is destroyed via deleveraging and insolvency. To combat these deflationary forces, the US Federal Reserve has printed $3 trillion dollars (inflationary force) and injected those dollars into the economy to prop up asset prices and further strengthen bank balance sheets. US break-even rates (the difference in yield between inflation-protected securities and nominal debt of the same maturity) have been trending upward since March 2020 (see chart below). Positive break-even rates suggest that traders are betting the economy may face inflation in the near future.

Summary:

Before jumping into trade ideas lets summarize the claims I have made so far. These are critical to my investment thesis.

Debt monetization (“money printing”): The Federal Reserve (“Fed”) accumulated more Treasuries within six weeks in early 2020 than the entire foreign sector accumulated over the past six years. This “new” money has made its way into the financial system (banks are well capitalized) and has supported asset prices (excess liquidity has a strong correlation to higher stock prices due to multiple expansion). In other words, expanding deficits and debt monetization are good for stocks and the broader economy but they are not sustainable in the long run.

COVID-19 case count: We have seen a resurgence in US COVID-19 cases led by southern and western states (possibly due to premature re-opening plans and procedures). The 7-day moving average of COVID-19 deaths is back above 800 per day. Clearly these trends are not heading in the right direction and it should cause some concern for investors.

Employment statistics: Continuing jobless claims have started to level off and have been declining for the past 6 weeks. However, we have had 17 straight weeks of initial claims levels above the 1 million mark. Permanent layoffs have also risen by 1.6 million in just four months. This is especially concerning in light of the looming expiration of supplementary unemployment benefits ($600/wk) in July 2020. If there is a retrenchment of fiscal support and COVID-19 case count continues to rise, we may see a pullback in the market in Q3 or Q4 (although this is not my base case)

Dollar weakness: The dollar started the year on very strong footing. However, the federal reserve decided to cut rates in response to the crisis making the US market less competitive for investment dollars. More recently, the Fed also provided dollar liquidity currency swap lines to foreign central banks allowing them to access dollars as required when there is a shortage. In other words, the factors that were pushing the dollar up historically have reversed their trends. The combination of all these factors have made left tail events (dollar devaluation) more likely than right tail events (dollar appreciation). The most likely scenario (in my mind) is that the US will continue to struggle with the virus while Europe and Asia will recover faster. This in combination with more debt monetization (“money printing”) in the US will cause the dollar to decline relative to other currencies (although the time horizon for this is still unknown).

Inflation expectations: According to Lyn Alden, the US lost ~$7 trillion of cumulative net worth in Q1 2020 (as compared to $11 trillion in the 2008 recession). This is an inherently deflationary shock as monetary value is destroyed via personal deleveraging and business insolvency. To combat these deflationary forces, the US Federal Reserve has printed $3 trillion dollars (inflationary force) and injected those dollars into the economy to prop up asset prices and further strengthen bank balance sheets. US break-even rates (the difference in yield between inflation-protected securities and nominal debt of the same maturity) have been trending upward since March 2020 (10-year break-even rate is 1.48% as of July 21, 2020). Positive break-even rates suggest that traders are betting the economy may face inflation (rather than deflation) in the near future.

Conclusion: How do you trade in this environment?

If the dollar strengthens and deflation takes hold it may cause a broad sell-off in equities. If the dollar continues to weaken (and the fed / treasury step in to support markets with more monetary and fiscal stimulus) then stocks may rally and fund managers may rotate away from growth stocks (tech) into value stocks (industrial, financial). Commodities (steel / copper) and precious metals (gold / silver) may also do well in this environment. Gold and silver have already started to outperform relative to the S&P.

DISCLAIMER

NO INVESTMENT ADVICE

This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content on the site before making any decisions based on such information or other content.

Solid work, Rishabh! Excited to read more from you :)