Markets are Bullish!

Don't fight the market short-term, but understand the stagflation bill is coming

TL;DR

In my last post, I outlined two scenarios that could play out in markets:

The "Art of the Deal" Works (Temporarily): Following Trump's negotiation playbook, major countries negotiate seemingly favorable deals with the US over the next 60-90 days (risk-on)

Technical indicators confirm this trend with multiple positive closes on the S&P 500 with breadth improving (advance-decline turning positive)

The “Revenge of the Creditors”: Simultaneous selling of Treasuries by foreign creditors (in response to the trade war) could drive up yields, causing dislocation in the bond market (risk-off).

Where are we today relative to these two scenarios?

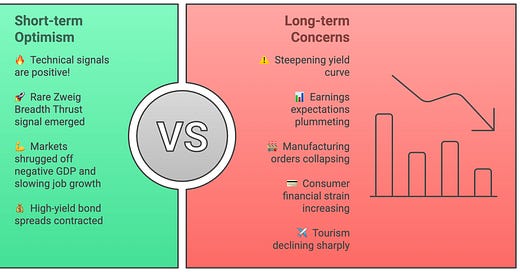

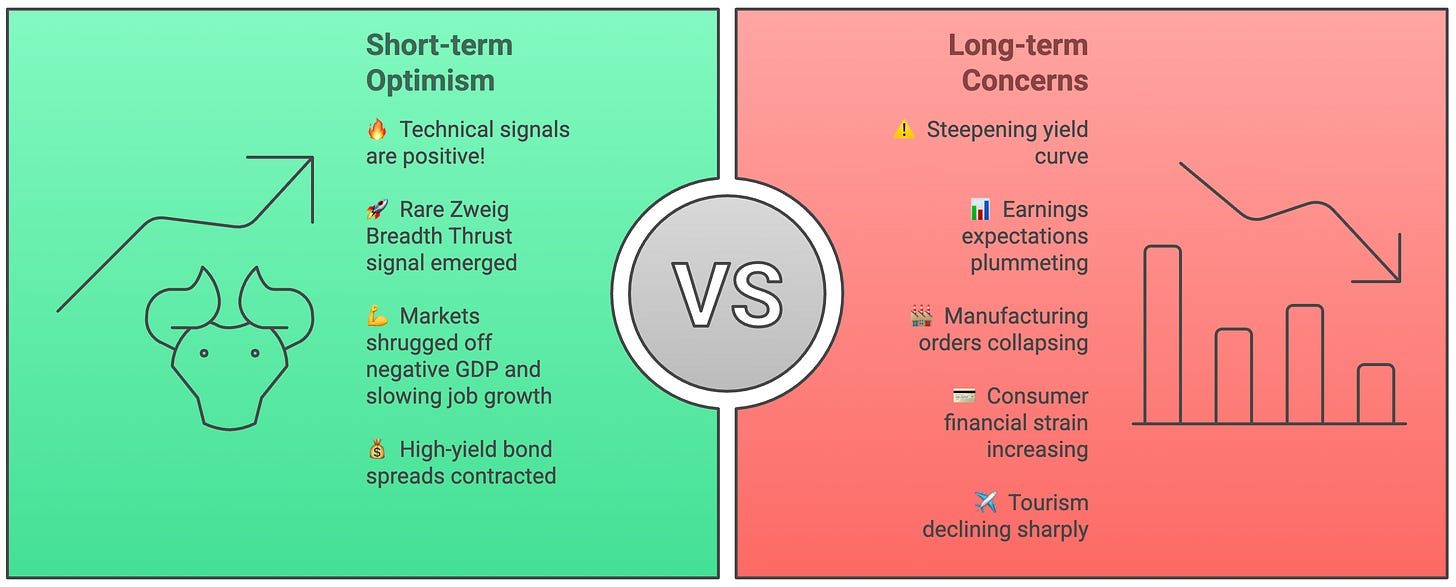

While markets appear to be validating the "Art of the Deal" scenario in the short term with positive technical indicators, these deteriorating economic fundamentals suggest that any trade deals may only temporarily mask deeper structural damage already taking place in the economy. The stagflationary impact of tariffs is beginning to materialize regardless of market optimism about potential negotiations.

The steeping yield curve directly validates the "Revenge of the Creditors" scenario, albeit in its early stages. While we haven't yet seen mass selling of Treasuries by foreign holders, the steepening yield curve suggests the market is beginning to price in this risk. As trade tensions escalate, the probability of this scenario playing out more dramatically increases significantly.

How am I positioned?

TL;DR - Don’t fight the market in the short-term. I bought some exposure to the S&P last week via SPLG and some OTM call options on the index. However, while technical indicators are pointing to a near-term bottom, they don't eliminate the possibility of a technical recession in 2025. The impact of tariffs on consumer prices and business confidence could still materialize over time, even if markets have priced in the initial shock. The assumptions supporting my view are below.

Disclaimer: The views and opinions expressed are solely those of the author and do not necessarily reflect those of the author's current employer. This material is for informational purposes only and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. The author is not responsible for errors, inaccuracies, or omissions of information; nor for the accuracy or authenticity of the information upon which it relies.

Short Term - Don’t fight the market

Market data provides clear signals about which narrative currently has momentum.

In the short term, it seems scenario 1 is showing some promise.

Patterns are positive: The S&P 500 is showing a technically constructive pattern of higher highs and higher lows on generally supportive volume. May 1's session demonstrated particularly strong institutional buying interest, especially in the technology sector.

Breadth improved: A Zweig Breadth Thrust signal emerged on April 24, 2025, which is a rare and historically bullish indicator. The Zweig Breadth Thrust indicator has been 100% accurate since 1957, with the S&P 500 always generating positive returns during the six months following such signals.

Market moved past bad economic data: The market received bad economic data (negative GDP and job growth cut in half) but didn't sell off. The markets are viewing the negative GDP print as a temporary dislocation rather than a fundamental economic weakness. It was caused by imports soaring 41.3% (negative impact on GDP), which may be a temporary phenomenon due to tariffs.

Bond spreads are declining: High-yield bond spreads have recovered 50% of their widening as of April 23rd, showing improving credit market conditions.

TL;DR - Don’t fight the market. I bought some exposure to the S&P last week (I was limited to ~15-25% exposure, but readers with different risk profiles might consider higher allocations).

Medium Term - We are not out of the woods

In the medium term, I think scenario 2 still holds. The Apollo data discussed below points to deteriorating business confidence, declining capital expenditures, and increasing consumer financial strain—all classic precursors to economic stagflation. While markets can certainly climb this wall of worry in the near term, you should remain vigilant about these medium-term structural challenges.

First, let's start with positive news. The data suggests that while there was indeed a significant flight from US dollar assets in mid-April following the tariff announcements, this trend has moderated considerably in recent weeks. Markets have stabilized, successful Treasury auctions have demonstrated continued foreign demand, and yields have retreated from their highs.

Now for the bad news. The Apollo chartbook outlines a timeline for economic deterioration following the April 2, 2025, "Liberation Day" tariffs. Torsten Slok, Partner and Chief Economist at Apollo, predicts this ends in recession.

Two significant problems are emerging that suggest caution is warranted despite the positive technical setup.

Problem 1: Stagflationary Shock

Apollo concludes that a trade war represents a stagflation shock—combining recession and inflation pressures simultaneously (page 39). While some short-term adaptations are occurring (such as inventory building and supply chain diversification), and there are recent signs of potential tariff exemptions or negotiations, the overall weight of evidence suggests significant economic challenges ahead.

There are a few pillars that support this view:

Earnings Expectations and Confidence Declining: The Apollo report shows the sharpest decline in earnings outlooks since 2020 (page 6), with CEO confidence declining significantly (page 16). Consumers are worried about job security, with Apollo data showing a sharp increase in the percentage of consumers expecting unemployment to rise (page 23). This is consistent with a Reuters poll showing that economists now expect the economy to grow just 1.4% in 2025, down from 2.2% predicted a month earlier, with the probability of recession in the next 12 months approaching 50%

Order Volumes Declining and Capital Expenditures Grinding to a Halt : Apollo data shows manufacturing new orders collapsing (pages 7 and 10) with sharp reversals in corporate capital expenditure plans (page 8). This matches economist observations that tariff uncertainty is causing businesses to delay investments and reduce orders,

Credit and Financial Strain: Apollo data indicates increasing financial strain on consumers, with rising shares of credit card accounts only making minimum payments (page 30) and increasing delinquency rates (page 31). This matches RBC analysis that "Tariffs will impact all U.S. consumers, but the burden will be heavier for low-and-middle-income earners, who devote a greater share of their take-home pay to purchasing essentials"

Tourism and Discretionary Spending: The Apollo report highlights declining tourism, particularly international visits (page 28-29), and falling hotel demand (page 35). This matches recent data showing declining international arrivals to the US, with data from Western European countries showing year-over-year declines of 20-30% in travel to the US

While markets appear to be validating the "Art of the Deal" scenario in the short term with positive technical indicators, these deteriorating economic fundamentals suggest that any trade deals may only temporarily mask deeper structural damage already taking place in the economy. The stagflationary impact of tariffs is beginning to materialize regardless of market optimism about potential negotiations.

Problem 2: Revenge of the Creditors

Despite expectations of Fed rate cuts and softening growth, long-end yields are rising and the yield curve is steepening. Recent data shows that the spread between 10-year and 2-year Treasury yields has widened significantly, and this phenomenon has persisted into May 2025. This presents a paradox, as traditionally, yield curves steepen during periods of economic expansion, not contraction.

It is pretty clear to me that demand for US financial assets is slowing faster than the reduction in US financing needs. As Warren Buffett notes, the US is “like a wealthy family selling off parts of its land to finance excess consumption”. While US Treasury issuance remains high to fund government operations, there appears to be changing dynamics in who's buying this debt (e.g., foreign creditors are catching on).

As of June 30, 2024, foreign investors held approximately $12.7 trillion in long-term debt securities (approximately 30% of all U.S. Treasury securities), making their buying patterns critically important to market stability. Recent auctions of Treasury securities have shown variable demand from foreign buyers, with some auctions seeing strong international participation while others show more tepid interest.

The consistency of this Treasury demand is now in question, especially as geopolitical tensions rise and US trade policy shifts dramatically. With potentially reduced foreign demand for US government debt, yields will need to rise to attract sufficient buyers. The steepening yield curve signals that the market is pricing in this fundamental shift in capital flows.

Recap

For tactical investors, the constructive technical setup supports maintaining equity exposure while remaining nimble. I've acted accordingly by establishing a moderate position (15-25%) in the S&P 500.

Short-term outlook positive: I am cautiously optimistic about the markets in the short term (positive technical indicators like the Zweig Breadth Thrust signal, improving market breadth, and the market's resilience to bad economic data).

For long-term investors, it's crucial to recognize that we're witnessing the early stages of a significant disruption in the relationship between US trade deficits and capital inflows. The steepening yield curve amid economic softening is the market's way of pricing this risk. Ultimately, the prudent approach is respecting what the market is telling us now while preparing for the potential challenges that lie ahead.

Medium-term concerns:

Stagflationary shock from trade policies (combining recession and inflation)

Declining earnings expectations and business confidence

Decreasing order volumes and capital expenditures

Consumer credit strain and financial pressure

Declining tourism and discretionary spending

Long-term concerns: Early innings of a significant disruption in the decades-old relationship between US trade deficits and capital inflows.

The Treasury market is sending warning signals through the steepening yield curve amid softening economic conditions.

Foreign demand may be weakening due to geopolitical tensions and changing US trade policies.