TL;DR

The significant rally of the S&P 500 in 2023, the creation of 199,000 new jobs in November, a drop in unemployment to 3.7%, and the uptick in the Non-Manufacturing Purchasing Managers' Index to 55.8 collectively signal robust economic activity, strong labor demand, and investor confidence.

However, bearish indicators offer cautionary notes: the Core Personal Consumption Expenditures (PCE) and Consumer Price Index (CPI) hint at persistent inflationary pressures, and the manufacturing sector shows signs of contraction with the ISM Manufacturing Prices Index and Purchasing Managers Index both signaling a slowdown. Furthermore, the second-order effect of the strong jobs report is that the Fed may not be pressured to cut rates as soon as predicted. Taken together, these indicators reflect an economy experiencing vigorous growth in certain sectors (services and labor) while also facing inflation challenges and potential manufacturing sector headwinds.

What are the implications for you?

Average hourly earnings have increased, and business inventories are growing, suggesting healthy consumer spending ahead.

Sectors that stand to benefit from increased consumer purchasing power, like technology, consumer services, or retail could be attractive.

The contraction in manufacturing activity could be a precursor to broader economic challenges.

Perhaps reduce exposure to cyclical or manufacturing stocks

As the Federal Reserve navigates inflation, interest rate changes will impact both bond yields and stock market valuations.

Retail traders should stay informed about Fed policy shifts, as rising rates can depress bond prices and make certain high-valuation stocks less attractive.

Economic Signals

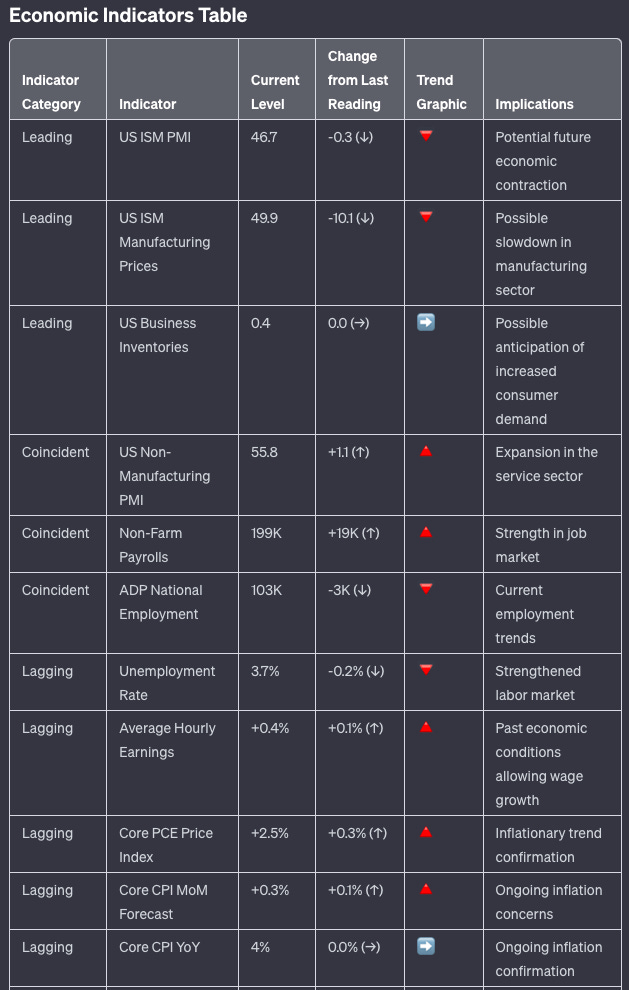

Leading Indicators:

These predict future economic activity and typically change before the economy as a whole changes.

United States ISM Purchasing Managers Index (PMI): The PMI has dipped to 46.7, suggesting future contraction in manufacturing activity.

United States ISM Manufacturing Prices: A decrease to 49.9 in this index could indicate a forthcoming slowdown in the manufacturing sector.

United States Business Inventories: An increase to 0.4 suggests that businesses might be expecting increased consumer demand, which can lead to future economic growth.

Coincident Indicators:

These indicators change at approximately the same time as the whole economy, thereby providing information about the current state of the economy.

United States Non-Manufacturing PMI: An uptick to 55.8 represents current expansion in the service sector.

Non-Farm Payrolls: The addition of 199,000 jobs reflects the current strength of the job market.

ADP National Employment: The addition of 103,000 jobs is indicative of current employment trends.

Lagging Indicators:

These indicators change after the economy as a whole does and confirm long-term trends.

Unemployment Rate: The decrease to 3.7% confirms the past trend of a strengthening labor market.

Average Hourly Earnings: A rise of 0.4% in earnings is indicative of past economic conditions that have allowed for wage growth.

Core Personal Consumption Expenditures (PCE) Price Index: The 2.5% increase over six months gives insight into previously occurring inflationary trends.

Core Consumer Price Index (CPI): The month-over-month forecast rise of 0.3% and the year-over-year steady 4% rate confirm the trend of ongoing inflation.

DISCLAIMER

Opinions expressed are solely my own and do not express the views or opinions of my employer.

NO INVESTMENT ADVICE

This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content on the site before making any decisions based on such information or other content.

INVESTMENT RISKS