My Investment Process for FY24

I wanted to outline my investment principles to kick off 2024 and propose a new format to this blog to reflect those principles. In this post, I'll explain this approach and conclude with my portfolio positioning recommendation for the year (educational purposes only; not investment advice; see the disclaimer).

Investment Process

Markets, as social constructs, are influenced by investor expectations, fundamentals, and liquidity. Success in markets hinges on accurately predicting changes in expectations and sizing positions correctly. Fundamentals provide insights into outcomes not fully appreciated by the market.

My blog should reflect this investment approach. Each post this year will include three sections aligned to the above criteria:

Investor Expectations

Fundamentals

Liquidity/Flows

I may include additional sections (e.g. risks, secular trends) to the extent they impact my market positioning. Each post will end with a synthesized sample portfolio (again - not investment advice; see disclaimer below). Regular postmortems will be performed to analyze errors or mistakes in position sizing if I am wrong. This is really to help me get better and to take you along for the journey. Hopefully it is helpful to you.

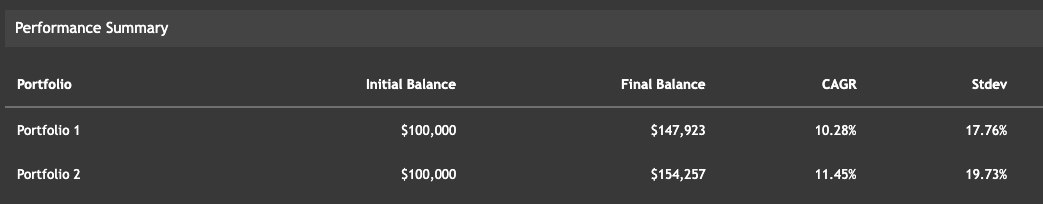

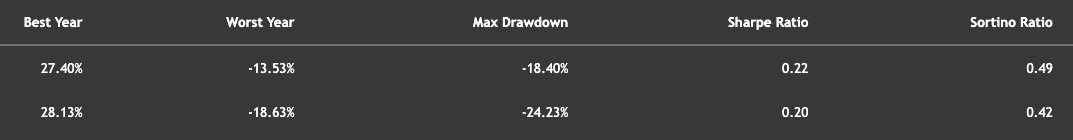

I won’t bury the lede - here's a quick snapshot of my recommendations (educational purposes only; not investment advice - refer to the disclaimer below). The portfolio has an 85% equities / 15% fixed income allocation. The portfolio would have returned 10.24% with a st. dev. of 17.8% on a 4-year backtest (Jan-20 to Jan-24), which slightly underperforms the SPY but has lower volatility and higher sharpe ratio. For more detailed statistics on the backtest, please look at the tables below (Portfolio 1 - below; Portfolio 2 - 100% SPY).

Investor Expectations

Recent sentiment surveys highlight a significant bullish shift in both investor and consumer outlook, marking an important change in market expectations for 2024. The AAII and University of Michigan surveys have reported a notable rise in optimism, which traditionally correlates with increased consumer spending (a key driver of corporate revenue growth).

The University of Michigan survey, recorded a 29% surge in consumer sentiment, the largest increase since 1991, with inflation expectations falling to 2.9%, the lowest since December 2020. With consumers powering over 65% of GDP, their renewed optimism supports higher corporate revenues.

Bullish investor sentiment in the AAII survey has been above historical averages for 11 weeks.

The bull-bear spread in the AAII survey widened to 13.6%, indicating a pronounced shift toward bullishness.

Other consumer surveys, including the Conference Board and NY Fed surveys, also show significant improvements across various demographics.

The Federal Reserve's interest rate decisions are pivotal in shaping stock market movements. Investor expectations for multiple rate cuts are waning due to strong economic indicators, challenging the assumption that easy monetary policies will continue. That is causing some headwinds, however this seems largely priced in.

Expectations for interest-rate cuts have been a driving force behind recent stock market rallies. The Federal Reserve officials, including Governor Christopher Waller, have expressed caution against rushing to cut rates.

The bond market's reaction to the Federal Reserve's policy signals, as seen in the yield movements, indicates market sensitivity to interest rate expectations. The 10-year U.S. Treasury yield, for instance, finished at a higher rate than it started the year, reflecting the shift in market expectations regarding the Federal Reserve's policy direction.

Traders are now betting that inflation will average above the Federal Reserve's target over the next five years, as indicated by swap contracts tied to the consumer-price index. This suggests a higher perceived risk of inflation persisting, which could influence the Federal Reserve's decisions on interest rates.

The forward-looking measures of inflation (FWD INFL 1x5Y and FWD INFL 5x5Y) are trending above the 2% level, supporting the claim that traders expect inflation to average above the Federal Reserve's target over the next five years.

Fundamentals

The US stock market is underpinned by solid fundamentals, as evidenced by strong labor, inflation, and sector indicators. The labor market remains robust, with higher-than-expected job creation and a lower-than-expected unemployment rate. Inflation continues but shows signs of moderation. The retail sector reflects healthy consumer spending, while the housing market, despite some slowdown, indicates active engagement. These robust indicators provide a solid foundation for sustained positive market performance.

Leading Indicators

Stock Market Returns

The S&P 500 just reached an unprecedented new record high, closing at above 4800. This milestone reflects tremendous investor confidence in future growth as the index surpassed its previous high from 2 years ago.

Inflation Expectations

CPI inflation fell by 3.1%, from 6.5% in December 2022 to 3.4% in December 2023 (vs. over 9% in mid-2022).

Core inflation (ex-volatile food and energy prices), came in at 3.9%, down 1.8% from its 12-month Dec 2022 rate of 5.7%

Housing

Home Sales and Median Prices: Despite a 19% drop in existing home sales in 2023, median home prices rose by 41% from December 2019 to December 2023.

Builder confidence rebounded to a 7-month high in January 2024, according to NAHB.

Building permits rose by 1.9% to a seasonally adjusted annual rate of 1.495M in December 2023, up from November's 1.467M and above market expectations of 1.48M.

Coincident Indicators

Hiring & Wage Growth

The ADP National Employment report indicates strong private sector hiring with 164,000 jobs added

Non-farm payrolls increased to 216,000 jobs in Dec-2023 (vs. 173K prior mo.), signaling labor market strength.

Real hourly wages of private-sector workers rose slightly last month (up 0.1% vs. +0.8% over the past year. This has accelerated in recent months, up 2.5% annualized over the past three months.

Retail Sales

Retail sales increased by 0.6%, higher than the expected 0.4%, showing that consumer spending remains robust despite inflationary concerns.

Manufacturing and Services

S&P Global Composite Flash PMI: The index improved slightly to 51 from the previous 50.7, indicating a marginal expansion in private sector business activity.

ISM Non-Manufacturing PMI stood at 50.6, signaling a slight expansion in the service sector but below the forecasted 52.6, pointing to a slower growth pace.

Lagging Indicators

GDP

GDP grew at a rate of 4.9% in Q4 2023, indicating substantial economic expansion.

Unemployment

The unemployment rate is at 3.7%, below the anticipated 3.8%

Liquidity/Flows

Based on the data in the H.8 release from the Federal Reserve, market liquidity is projected to increase in 2024. The Fed's steady approach to the Federal Funds Rate, along with increased bank credit and loan growth, signals a more liquid market environment. Additionally, the reduction in overnight reverse repo balances and the need for higher bank reserves indicate a shift towards a more accommodative monetary stance.

Supporting Details:

Total bank credit grew by 0.9% from November to December 2023, faster than the previous month. Faster credit growth indicates more liquidity flowing into the banking system.

Securities in bank credit, which declined through most of 2023, grew by 0.6% in December 2023. Growth in securities suggests banks are holding more assets that can be easily turned into cash.

Total loans and leases grew by 0.1% in December after declining in November. Commercial and industrial loans grew by 0.7% in December Accelerating loan growth points to easing lending standards that increase market liquidity.

The Federal Reserve's quantitative tightening is expected to slow, hopefully reducing upward pressure on rates.

Overnight reverse repo declined by $1 trillion since August 2022, from $1.7 trillion to $680 billion in Dec-23, signaling diminishing surplus cash in markets.

Risks

In 2024, geopolitical risks and market dynamics are critical themes for investor positioning. Geopolitical tensions, including key elections in major economies, escalating Middle East conflicts, the Russia-Ukraine war, and uncertainty surrounding Taiwan, pose significant risks that could disrupt global markets. In the U.S., the presidential election outcome may lead to substantial policy changes, influencing market behavior. Additionally, the stock market rally, dominated by a select group of technology companies, highlights potential vulnerabilities in investor portfolios. Finally, China's economic slowdown, particularly in the real estate sector, may have contagion effects.

Geopolitical risks will amplify economic uncertainty (Source: Guggenheim, 11 Macro Themes for 2024).

Over 50% of global GDP is covered by elections in key regions like the U.S., Taiwan, Russia, and the EU.

The Middle East is on the brink of a wider conflict, with Israel's war in Gaza escalating regional tensions, potentially impacting global oil flows and inflation rates.

The Russia-Ukraine war’s outcome could influence the US's global standing and lead to increased geopolitical tensions in other regions.

Escalation in tensions in Taiwan could have significant global economic repercussions, especially given Taiwan's key role in semiconductor production.

The upcoming US presidential election presents uncertainties, potentially leading to policy reversals and market reactions, as indicated by the prospects of a Biden-Trump rematch. Potential trade tensions, especially if former President Trump's proposed tariffs are implemented, could negatively impact the US GDP.

Limited market participation in the stock market rally (Source: Singh, These Four Questions Are Top of Mind for Investors in 2024)

The S&P 500 Index achieved new highs largely due to the performance of seven major technology companies, including Apple and Nvidia (Wittenstein, 2024). There are concerns about crowded positions in tech stocks and the risk of a sell-off if megacap stocks underperform.

The earnings season is pivotal, with major tech companies' results being highly influential. Apple's recent performance has been lukewarm (earnings report due Feb 1, 2024), while Microsoft's AI-infused products are expected to boost profits.

The S&P 500's leadership has shown shifts, with non-tech companies gaining prominence.

China's economic challenges, evidenced by its slowed growth and the struggles of its property sector, may impact global trade and investments.

China's economic slowdown and its limited scope for interest rate reductions pose significant challenges, as evidenced by the bearish sentiment toward Chinese assets, including stocks, the yuan, and government bonds.

China's economic uncertainties, particularly in its real estate sector, have led to a decrease in investor confidence, as demonstrated by the yuan's relative weakness and lower bond yields compared to other markets.

Portfolio Recommendation & Rationale

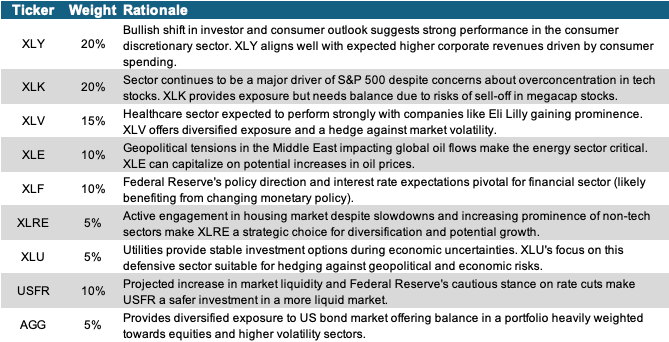

Here's a quick snapshot of my recommendations (not investment advice - refer to the disclaimer below). The overall strategy has an 85% equities / 15% fixed income allocation. This strategy aims to leverage the bullish consumer outlook and strong technology sector performance, while mitigating risks from geopolitical tensions, market liquidity, and Federal Reserve policies.

Consumer Discretionary (XLY) - 20%: The significant bullish shift in investor and consumer outlook, with consumer sentiment at its highest since 1991, suggests a strong performance in the consumer discretionary sector. XLY's focus on this sector aligns well with the expected higher corporate revenues driven by consumer spending.

Information Technology (XLK) - 20%: Despite concerns about over-concentration in tech stocks, the sector continues to be a major driver of the S&P 500's performance. XLK provides exposure to this influential sector but should be balanced given the potential risks of a sell-off in mega-cap stocks.

Health Care (XLV) - 15%: The healthcare sector, with companies like Eli Lilly gaining prominence, is expected to perform strongly. XLV's diversified exposure to this sector offers a potential hedge against market volatility and benefits from the sector's resilience.

Energy (XLE) - 10%: Geopolitical tensions in the Middle East and the impact on global oil flows make the energy sector a critical area. XLE can capitalize on potential increases in oil prices due to these tensions.

Financials (XLF) - 10%: The Federal Reserve's policy direction and interest rate expectations will be pivotal for the financial sector. XLF provides exposure to this sector, which could benefit from the changing monetary policy landscape.

Real Estate (XLRE) - 5%: With the active engagement in the housing market despite some slowdowns, and the increasing prominence of non-tech sectors, XLRE offers a strategic choice for diversification and potential growth

Utilities (XLU) - 5%: Utilities often provide stable investment options during economic uncertainties. XLU's focus on this traditionally defensive sector is suitable for hedging against geopolitical and economic risks.

Short-Term Floating Rate Treasurys (USFR) - 10%: Given the projected increase in market liquidity and the Federal Reserve's cautious stance on rate cuts, USFR offers a relatively safer investment option in a potentially more liquid market environment.

Core US Aggregate (AGG) - 5%: AGG provides diversified exposure to the US bond market, offering a balance in a portfolio heavily weighted towards equities and sectors with higher volatility.

As mentioned above, the portfolio would have returned 10.24% with a st. dev. of 17.8% on a 4-year backtest (Jan-20 to Jan-24), which slightly underperforms the SPY but has lower volatility and higher sharpe ratio (0.22 vs. 0.20).

Bibliography:

Bloomberg Economics and Bloomberg News. (2024). A Pessimist’s Guide to Global Economic Risks in 2024. Bloomberg.

Friedman, N. (2024). Home Sales Were the Lowest in Almost 30 Years in 2023. Wall Street Journal.

Guilford, G., & Omeokwe, A. (2024). Americans Are Suddenly a Lot More Upbeat About the Economy. Wall Street Journal.

Menton, J., Popina, E., & Turner, M. (2024). Five Charts Showing the S&P 500’s Wild Ride Back to Record Highs. Bloomberg.

Singh, Hardika. "These Four Questions Are Top of Mind for Investors in 2024." The Wall Street Journal, 16 Jan. 2024. Web. Accessed 20 Jan. 2024.

Wallerstein, E. (2024). Stocks Are at Record Highs, but Things Will Only Get Harder From Here. The Wall Street Journal.

Walsh, A., Bush, M., Giraldo, M., Traister, J., Dozier, P., Squillante, C., Cai, J., & Kleinman, M. (2024). 11 Macro Themes for 2024. Guggenheim Investments.

Wittenstein, J. (2024). Big Tech Still Rules Profit Growth Even as S&P Leadership Widens. Bloomberg.

Wong, M. (2024). Gloom Over China Assets Is Spreading Beyond Battered Stocks. Bloomberg.

DISCLAIMER

Opinions expressed are solely my own and do not express the views or opinions of my employer.

NO INVESTMENT ADVICE

This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content on the site before making any decisions based on such information or other content.

INVESTMENT RISKS