The Fed's Losses and the National Debt: A Recipe for Disaster?

The United States is on the precipice of a debt crisis that could send shockwaves through the global economy and financial markets. The Federal Reserve's recent troubles, coupled with the national debt surpassing a staggering $30 trillion, has sent alarm bells ringing and raises questions about the Fed's ability to function as a lender of last resort during financial crises. The sell-off of bank stocks, driven by concerns about the health of the banking sector and the Federal Reserve's aggressive interest rate hikes, underscores the severity of the situation. In this article, I will attempt to outline the key issues and propose potential solutions (particularly those addressing the fiscal gap and reducing the national debt) that can help us avert a crisis.

Let’s start with the Fed. Rising interest rates and a substantial balance sheet expansion from acquiring trillions of dollars in Treasury bonds and mortgage-backed securities (Alden, 2023) has presented significant issues at the Fed. These purchases were aimed at stimulating economic growth during the COVID crisis but made the Fed's balance sheet more susceptible to interest rate fluctuations. As interest rates rise, the Fed's interest payments on its holdings increase, consequently diminishing profits and potentially exacerbating losses (Alden, 2023). A recent Bloomberg survey revealed that 60% of respondents consider the current risks more significant than those of the 2011 debt crisis, and 41% expressed concerns about the US dollar's status as the primary global reserve currency (Mackenzie, 2023). If unaddressed, this situation could lead to severe ramifications, including a US debt default, which would have far-reaching implications for the global economy and financial markets.

Our second issue is related to the over $30 trillion national debt. The unsustainable growth rate of the national debt and the increasing wealth concentration in the hands of a few individuals and institutions are primary concerns. The debt burden has led to several adverse consequences for the US economy such as higher interest rates, inflation, and increased vulnerability to shocks, including recessions (Alden, 2023). In the event of a recession, raising taxes or cutting spending to repay the debt could exacerbate the downturn.

These concerns have also led to a significant sell-off of bank stocks. In the week ending May 10, investors pulled out $2.1 billion from financial stocks, the most since May 2022, and exchange-traded funds focused on the sector saw the largest exodus of cash since September (Barraud, 2023). The $29 billion Financial Select Sector SPDR Fund witnessed more than $2 billion withdrawn over just the past two weeks (Barraud, 2023).

The sell-off is driven by concerns about the health of the banking sector, fueled by the collapse of Silicon Valley Bank and other lenders over the past two months (Barraud, 2023). The Federal Reserve's aggressive interest rate hikes are also adding to the pressure on banks (Barraud, 2023).

Addressing these challenges requires swift action and fiscal responsibility from US lawmakers, who must prioritize setting aside partisan differences, seeking compromise, and assuming responsibility. Potential solutions include tax increases, spending reductions, and promoting economic growth. Both the government and the Fed must persist in adopting strategies that mitigate these risks and safeguard global financial stability (Alden, 2023).

Some countries, like France, have already started to take action to address their fiscal challenges. France, with a fiscal gap of 2.3%, is raising its retirement age to make it fairer for future generations (Keynote speech, 2023). In contrast, US politicians from different parties have largely agreed that entitlements should not be touched (Keynote speech, 2023). However, delaying action only worsens the problem as interest payments keep building.

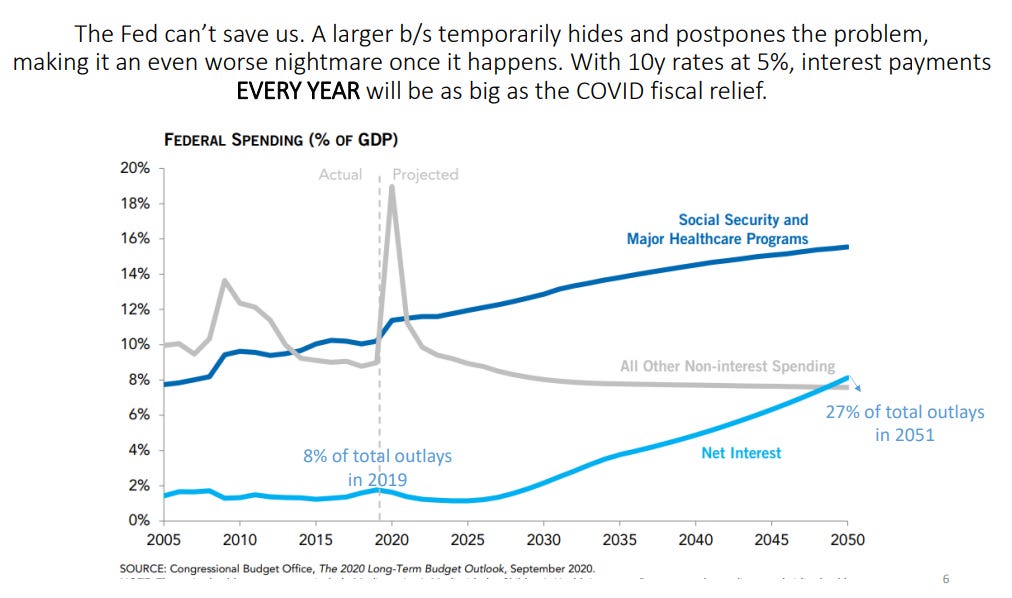

With interest rates at 5%, yearly interest payments could become as large as the entire COVID-19 relief of 2020 (Keynote speech, 2023). By 2050, interest payments could account for 27% of outlays, which is a nightmare for future economic growth, investment, productivity, and taxpayers (Keynote speech, 2023).

It is essential to recognize that cutting entitlements is not a choice but a necessity. Entitlements must either be cut today or will need to be cut much more drastically in the future (Keynote speech, 2023). Proactive measures to address the fiscal gap and reduce the national debt are crucial for ensuring the long-term stability of the US economy.

US lawmakers must work together to develop comprehensive strategies that balance the need for entitlement programs with fiscal responsibility. The current trajectory is unsustainable, and without intervention, the situation will only deteriorate further. By addressing the issue now, lawmakers can help mitigate the potential damage to future generations and the global economy.

References:

Alden, L. (2023, March 13). How the Fed "Went Broke". Lyn Alden. https://www.lynalden.com/broke-federal-reserve/

Barraud, C. (2023, May 14). Dip Buyers Scorched by Cratering Bank Stocks Rush for the Exits. Bloomberg. https://www.bloomberg.com/news/articles/2023-05-14/dip-buyers-scorched-by-cratering-bank-stocks-rush-for-the-exits

Mackenzie, M. (2023, May 14). Debt Ceiling Negotiations Have Investors Eyeing Gold if US Defaults. Bloomberg. Retrieved from https://www.bloomberg.com/news/articles/2023-05-15/debt-ceiling-negotiations-have-investors-eyeing-gold-if-us-defaults

U.S. Department of the Treasury. (n.d.). America's Finance Guide: National Debt. Fiscal Data. Retrieved May 14, 2023, from https://fiscaldata.treasury.gov/americas-finance-guide/national-debt/

Keynote speech for the 37th USC Marshall Center for Investment Studies Annual Meeting. (2023, May 1), from Stan Druckenmiller Speech

DISCLAIMER

Opinions expressed are solely my own and do not express the views or opinions of my employer.

NO INVESTMENT ADVICE

This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content on the site before making any decisions based on such information or other content.

INVESTMENT RISKS

There are risks associated with investing in securities. Investing in stocks, bonds, exchange traded funds, mutual funds, and money market funds involve risk of loss. Loss of principal is possible. Some high risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including a greater volatility and political, economic and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.