TL;DR

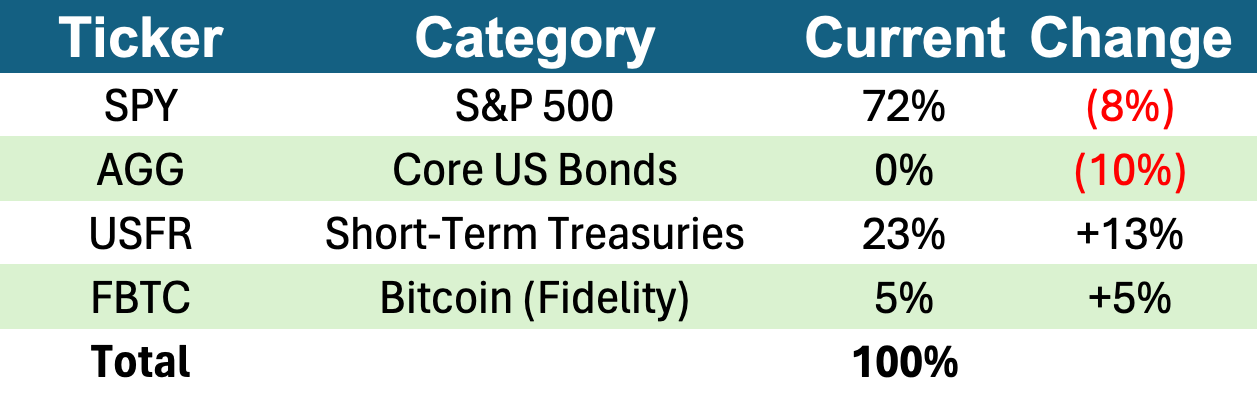

My core moves this week are:

Trim some of my equities exposure (S&P 500 “SPY”) slowly over the next 3-6 months and replace with the Floating Rate Treasury Fund (“USFR”).

This is primarily to lock in gains and benefit from high rates (Fed cuts are likely delayed due to sticky inflation).

If you want alternatives to SPY, consider adding exposure to ETFs that perform well in reflationary environments (see here for more info). Here some ETFs (credit to 42 Macro) that have performed well historically in a reflation environment.

Consider adding some exposure to Bitcoin via ETFs (Fidelity Wise Origin Bitcoin Fund “FBTC” - please see the prospectus for info and risk disclosures).

I will post later about the role Bitcoin ETFs could play in financial portfolios. My quick thesis is that Bitcoin performs well in reflationary environments and flows into Bitcoin ETFs have accelerated. The Bitcoin halving is also approaching in April this year which provides a near-term price catalyst.

Please note - Bitcoin exposure it is not for everyone. Be prepared for high risk and volatility. The “FBTC” ETF is for investors with a high risk tolerance. It invests in a single asset, bitcoin, which is highly volatile and can become illiquid at any time. Before investing in FBTC, investors should consider their time horizon, tolerance for risk, and personal financial situation. Please see disclaimer at the bottom of the post for more detail.

WHY?

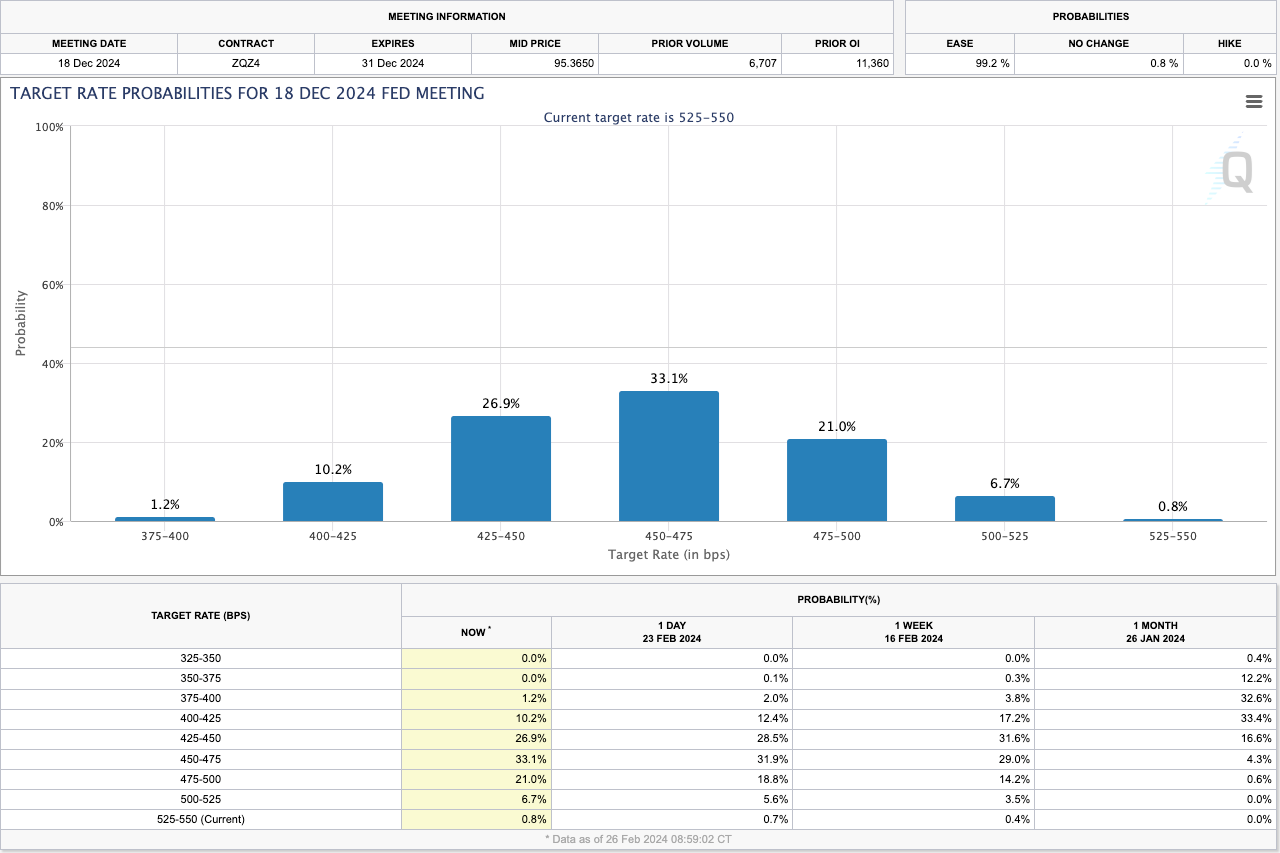

Recent data confirms the U.S. economy is re-accelerating faster than anticipated, supporting a hawkish pivot by the Fed on rate cuts. Futures markets are pricing in 3 rate cuts this year (vs. 6 cuts expected just 1 month ago)

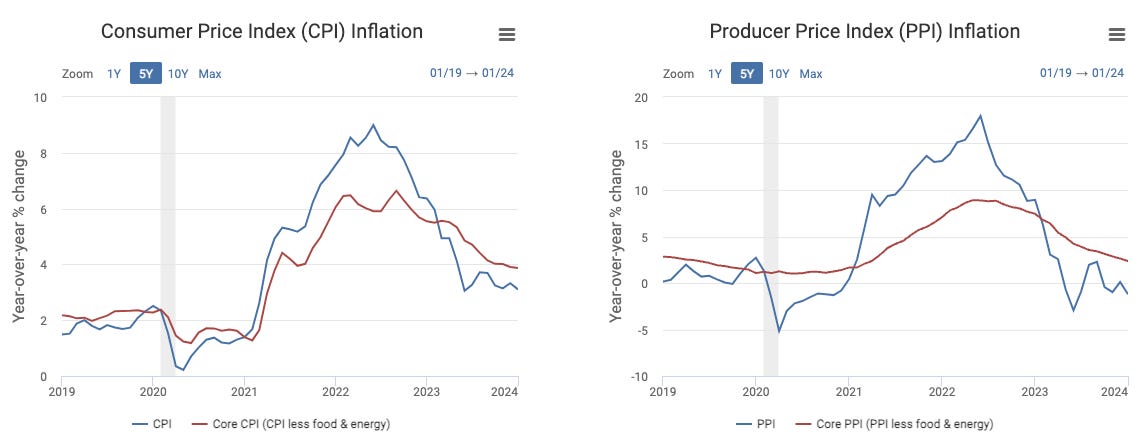

Inflation is proving to be sticky, meaning that we may be entering a reflationary period. Global supply chains are also strained due to the Red Sea conflict. This coupled with strong labor market and wage pressures could push inflation higher over time (bad for equities).

The US consumer is strong but losing momentum, as shown by weak retail sales growth in Jan 2024 relative to expectations.

The risk-reward for equities doesn’t look favorable (Goldman expects 2024 S&P 500 target to 5,200 - representing 3% upside vs. ~5% T-bill yield).

Fiscal policy remains expansionary with high deficits supporting growth. However, liquidity support is waning, as shown by the draining of the TGA and RRP. Bank lending standards are loose but I view this as unsustainable. Consumers seem to be increasingly tapping unsecured credit lines to fund purchases.

I think we are underestimating the probability of economic and political risks. Any combination of these could cause a correction in the near-term.

As always, please see the disclaimer at the bottom of the post.

Three Fed rate cuts expected this year (vs. six cuts expected 1 month ago)

Detailed View

Investor Expectations

Fed cut expectations tampered: Markets initially expected rate cuts, but hawkish Fed communication and economic data in January have curbed these expectations.

Rate markets are pricing in a higher terminal Fed funds rate, challenging the narrative of imminent rate cuts. The modal outcome is 3 rate cuts this year (vs. 6 rate cuts projected one month ago)

Risk-Reward limited: The risk-reward for equities doesn’t look to favorable relative to short-term treasuries which are yielding 5% on a risk-free basis.

Goldman has lifted its 2024 S&P 500 target to 5,200 (~3% upside).

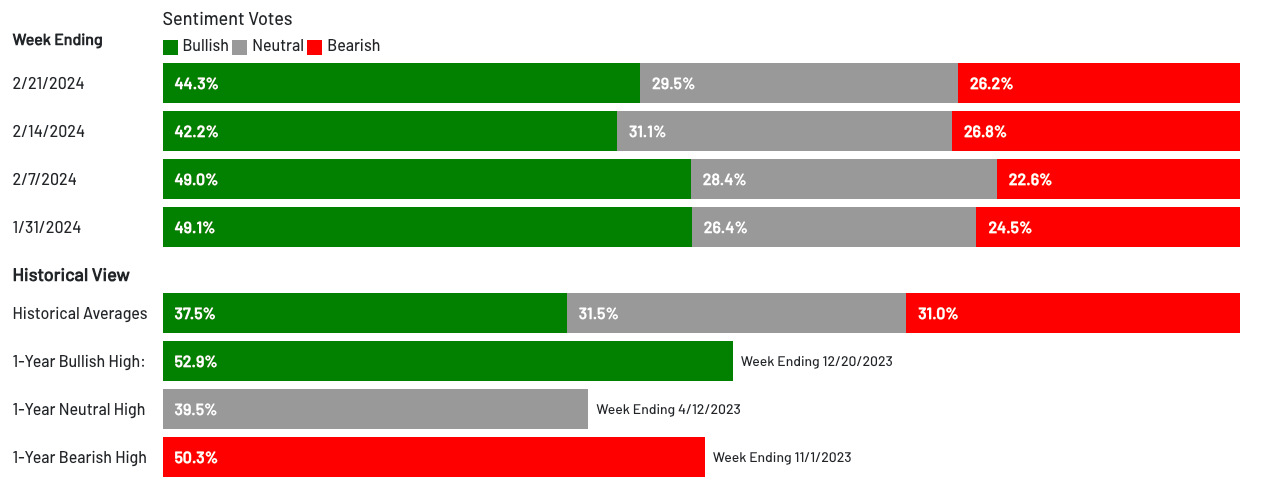

Investor Sentiment is bullish to an extreme: Investors are overweight equities and underweight cash, meaning a downside surprise could derail things.

Bullish sentiment, expectations that stock prices will rise over the next six months, increased 2.1 percentage points to 44.3%. Bullish sentiment is above its historical average of 37.5% for the 16th consecutive week.

Fundamentals

GDP projections for Q1-24 are increasing:

Atlanta Fed GDPNow estimate for Q1 GDP has increased to +2.9% (from +0.7% as of Feb 1)

The latest ISM Services, manufacturing data, jobs reports show re-acceleration in the economy.

Inflation is sticky: The latest CPI and PPI reports suggest inflation has not cooled as much as hoped. Sticky inflation in key areas like shelter and services reduces confidence that the Fed will cut rates (see here) until firmer disinflationary trends emerge.

January's headline inflation (CPI) came in at 3.1% versus expectations of 2.9%

Core CPI inflation remained disappointingly steady at 3.9% y/y

ISM services price data accelerated to 64.0 in January, the highest since 2012, while forecasts were just 57.4.

The shelter component within CPI has also accelerated for three straight months as rental costs rise amid strong housing demand and limited supply. The Fed watches this metric closely, so acceleration is worrying.

Global supply chains still a risk:

Overall container shipping still very depressed (Red Sea corridor operating at 50-60% of normal capacity).

Panama Canal is also operating at reduced capacity

The labor market showing signs of improvement: Both job growth and wage acceleration could contribute to inflationary pressures if not balanced carefully.

The economy added 353k jobs in January

Wage growth has moderated but persists at 5%+, reflecting ongoing labor market tightness.

Retail sales slipped: January showed a larger-than-expected pullback in consumer spending.

Retail spending fell by 0.8% from the previous month, following a 0.4% m/m increase in December.

Consumer demand for goods fell 1.1% from the month prior in nominal terms.

Liquidity/Flows

Liquidity support is waning: U.S. liquidity, defined as the Fed's balance sheet minus the change in the Treasury general account (“TGA”) balance minus the change in the reverse repo account, has an 89.3% R-squared correlation with the S&P 500 since 2009 (Johnson, 2024). On this metric, it seems liquidity support is starting to wane in February.

The Fed balance sheet has declined to $7.6 trillion (from Jan-24 peak of $7.7 trillion

The TGA has declined in February to $759.6B (from Jan-24 peak of $865.5M).

The reverse repo facility has declined to $524B (from Jan-24 peak of ~$1 trillion)

Massive concentration risk in the S&P 500: Massive inflows into passive investment vehicles have concentrated assets in the largest benchmark stocks like NVIDIA, providing artificial support.

The top 6 stocks in the S&P represent ~26% of the index (as of Feb-23-2024) NVIDIA’s gains are exacerbating the concentration risks (e.g. Nvidia has added about $600 billion in market value so far this year, more than it gained in the last seven months of 2023).

Earnings beats from major technology companies are continuing to drive positive momentum in U.S. stocks. Over time, this catalyst will fade and investors might sell and lock in gains.

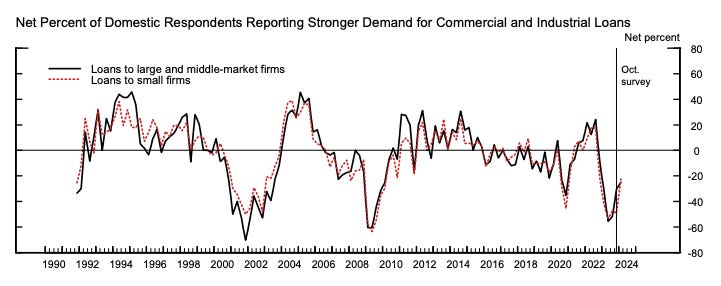

Credit conditions are easy:

The Senior Loan Officer Opinion Survey by Federal Reserve shows banks are easing lending standards across all loan types. The report also showed a pickup in loan demand, suggesting companies/consumers taking advantage of easier credit. While positive, I view this as a temporary phenomenon that can’t be sustained.

Bibliography:

Gordon Johnson (2024). 42 MACRO PRO TO PRO with Gordon Johnson - February 14, 2024

Menton, J., & Elbahrawy, F. (2024). Goldman Lifts S&P 500 Target With Profit Optimism to Drive Rally. Bloomberg.

DISCLAIMER

Please do not redistribute this email, any information or communications (the “Content”) provided by me to any other person, including forwarding, posting, framing or publishing any of our content on any third-party website or social media platform without express written permission.

I do not provide, and no portion of our Content purports to be, individualized or specific investment advice and I do not provide investment advice to individuals. All information provided is general in nature and is made without regard to individual levels of sophistication or investment experience, investment preferences, objectives or risk parameters and without regard to the suitability of the Content for individuals or entities who may access it. No information provided should be construed as an offer to sell, or a solicitation of an offer to buy any security or investment vehicle, nor should it be construed as tailored or specific to you, or any reader or consumer thereof. You understand and agree that our Content does not constitute specific recommendations of any particular investment, security, portfolio, transaction or strategy, nor does it recommend any specific course of action is suitable for any specific person or entity or group of persons or entities. The Content is based upon information from sources believed to be reliable. I am not responsible for errors, inaccuracies or omissions of information; nor am I responsible for the accuracy or authenticity of the information upon which it relies.

Educational Purposes Only: The content provided in this post is for educational purposes only and should not be construed as investment advice or a recommendation to buy, sell, or hold any securities mentioned. You should consult your own investment, legal, tax, and/or similar professionals regarding your specific situation and needs.

Personal Views and Risk Tolerance: The views and opinions expressed in the Content are my own and not those of any of my current, previous, or future employers. The investment strategies and beliefs discussed are personal to me and may not be suitable for all investors. My risk tolerance and investment objectives may significantly differ from yours.

Potential Conflicts of Interest: At any point in time, I may own a portion of or all the securities discussed in the Content.

Market Risks and Volatility: All investments involve risks, including possible loss of principal. Particularly, investments in cryptocurrencies like Bitcoin are highly speculative and can be extremely volatile.

Consult a Professional: Each individual's investment strategy is unique and based on personal financial circumstances and goals. Therefore, you should seek the advice of qualified financial advisors before making any investment decisions.

NO INVESTMENT ADVICE

This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice.

All content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content on the site before making any decisions based on such information or other content.

Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

INVESTMENT RISKS