US Equities: Time to Invest

In my last article, I said the risk-reward for investing in equities is low (as compared to the risk-free rate). While still true, I think we are at an inflection point now. As 2024 approaches, economic activity remains strong, and inflation is declining, suggesting a potential soft landing for the economy. This is a good setup for equities.

Positive Signals

Strong Macro Signals: The U.S. economy has shown exceptional resilience despite significant monetary tightening.

Gross domestic product increased at a 5.2% annualized rate in Q3 2023, revised up from the previously reported 4.9% pace.

Consistent productivity growth (4.7% in the third quarter of 2023) is seen as key to a soft landing. Long-run trends in productivity have been stable, with the trailing 10, 20, and 30-year means at approximately 1.4%, 1.6%, and 1.9% respectively.

Risk of recession in the next 12 months is estimated at only 15% currently. (Bloomberg - Odd Lots, November 2023).

Disinflation: Inflation is moderating. This could prompt the Federal Reserve to pivot towards easing monetary policy, historically accommodative for stocks (Goldman Sachs Asset Management, 2024).

The easing of the core PCE price index to 3.5% annually suggests successful inflation control. The decline in inflation, without large labor market impact, shows proof that the Fed's tightening has been effective.

The anticipated shift in Federal Reserve policy towards easing could historically benefit the equity market.

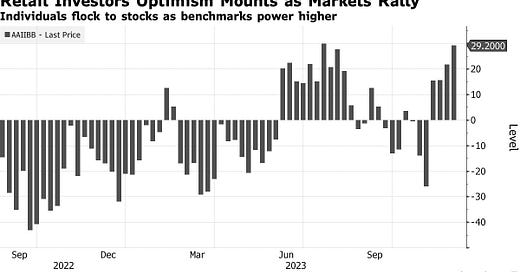

Positive Market Sentiment: Investors are bullish on equities.

According to the AAII Sentiment Survey, bullish sentiment (expectations that stock prices will rise over the next six months) increased 3.5 percentage points to 48.8% (vs. historical average of 37.5%).

The bull-bear spread (bullish minus bearish sentiment) increased 7.5 percentage points to 29.2%. The bull-bear spread is above its historical average of 6.5% for the fourth time in eight weeks.

Robust Labor Market: The labor market is improving. Steady wage growth underpins consumer spending, a critical driver of the equity market.

The US job market added a 150K jobs monthly in October.

Initial jobless claims fell to a seasonally adjusted 217,000 (Nov. 4) from an upwardly revised 220,000 in the prior week

Wage growth is decelerating as job openings decline and quit rates normalize. Furthermore, real wage growth has recovered, supporting real income growth around 4% in 2023.

Growth in consumer spending, which accounts for more than two-thirds of U.S. economic activity, was lowered to a still-solid 3.6% rate.

Negative Signs

It's not all smooth sailing. The longer high rates persist, the more significant the economic pain. However, most of the factors below have been “known” for some time, so my view is that they are priced into markets already. Time will tell if I am right.

Risk of Economic Slowdown

Claim: Recent economic strength has been underpinned by unsustainable factors, such as the spending down of excess savings by households and corporates. Many have concerns over reduced fiscal support, including the impact of student loan moratorium and reduced budget deficits.

Rebuttal: The current economic resilience suggest that the market is well-equipped to navigate these challenges. While excess savings and fiscal stimulus played a role in economic recovery post-pandemic, other factors have also contributed. For example, the U.S. labor market has shown remarkable resilience and corporate earnings have rebounded strongly. Furthermore, the Fed has “more ammunition” to combat slowdowns by shifting to accommodative monetary policy (e.g. rates can be cut).

Increasing Fiscal Deficits

Claim: The recent economic strength is underpinned by unsustainable factors such as high government deficits and could be destabilized with rising rates.

Rebuttal: The increase in the federal budget deficit in FY 2023 was largely due to temporary or one-off factors, which do not fundamentally alter the fiscal outlook for the U.S. (Brookings, 2023). Persistently high interest rates, however, could exacerbate fiscal sustainability challenges unless accompanied by higher productivity growth.

Higher Long Rates

Claim: Persistently high interest rates could reduce consumer spending and investment, squeezing corporate profits and affecting stock performance (Goldman Sachs Asset Management, 2024).

Rebuttal: Many corporations have shown a remarkable ability to adapt to changing economic environments, including high-interest rate scenarios. They have pushed out maturities of their debt, implemented cost-cutting, and made efficiency improvements to maintain profitability. On the demand side, factors such as stable employment, wage growth, and accumulated savings have cushioned the impact of increased borrowing costs.

Corporate Defaults Increase

Claim: The longer high interest rates persist, the more significant the accumulated pain, especially for lower-rated corporate borrowers. Rising corporate defaults could undermine market confidence. Standard & Poor's (S&P) predicts that by September 2024, the rate of defaults among "speculative-grade"companies will rise to 5% (vs. 4.1% in September 2023).

Rebuttal: The defaults are sector-specific (consumer, healthcare) and the broader market continues to show robust fundamentals. Furthermore, defaults are often anticipated and priced into the market.

Geopolitical Risks

Claim: Unpredictable geopolitical shifts could create market volatility. Rising government debt, internal and political conflicts, and external conflicts (e.g. Israel-Hamas war) could affect potential outcomes.

Rebuttal: While geopolitical shifts, rising government debt, and conflicts can introduce elements of uncertainty and volatility, the overall impact on global markets is often mitigated by factors such as market resilience, and diversification. While conflicts like the Israel-Hamas war have regional implications, their direct impact on global markets is often limited unless they significantly disrupt major economic or trade routes (so far not the case).

Bibliography

Bridgewater Associates. (2024). The Grind Ahead.

Brookings Institution. (n.d.). Why did the budget deficit grow so much in FY 2023? And what does this imply about the future debt trajectory? Retrieved from https://www.brookings.edu/articles/why-did-the-budget-deficit-grow-so-much-in-fy-2023-and-what-does-this-imply-about-the-future-debt-trajectory/

Dalio, R. (2023, November 27). US Political Conflict: The Odds of Smart Bipartisan Leadership Are Rising.

Goldman Sachs Asset Management. (2024). Asset Management Outlook 2024.

Lazard Asset Management. (2024). Global Outlook 2024.

Odd Lots. (2023, November 27). Goldman's Jan Hatzius Believes the Hard Part Is Over [Audio podcast episode]. In Odd Lots. Bloomberg

DISCLAIMER

Opinions expressed are solely my own and do not express the views or opinions of my employer.

NO INVESTMENT ADVICE

This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content on the site before making any decisions based on such information or other content.

INVESTMENT RISKS