USA on the Rebound?

The past week, marked by widespread market rallies, saw three of the biggest US banks - JPMorgan, Citigroup, and Wells Fargo - reporting optimistic quarterly earnings that exceeded analyst predictions. This positive trend bolstered a market that is increasingly betting on a "Goldilocks scenario," which implies a quick easing of inflation without pushing the US into a recession. In such a Goldilocks scenario, characterized by low, non-recessionary growth and disinflation, stocks typically perform well. Mohamed El-Erian, a long-time skeptic of the Fed remarked "You cannot get in the way right now of the soft-landing narrative—that narrative is building momentum” (link).

📈 Positive Indicators 📈

There are plenty of reasons for optimism. Several factors contribute to a positive outlook. These include the resilience of consumers backed by savings and low unemployment, easing inflation expectations, favorable fiscal policy, and healthy corporate profits and balance sheets. The current data suggests that the U.S. has sufficient momentum to tackle short-term headwinds.

Consumers

U.S. consumers remain financially healthy. Households hold $18.2 trillion in liquid assets, up over $5 trillion from pre-pandemic (UBS Editorial Team, 2023). Total wealth has also spiked 25% to 950% of GDP, enabling robust spending (UBS Editorial Team, 2023). Furthermore, consumer debt service costs are just 9% of disposable income despite rate hikes.

The labor market remains tight. The unemployment rate has declined to 3.2%, the lowest level since the late 1960s (UBS Editorial Team, 2023). Furthermore, job openings still very elevated at 9.8M in May-23, pointing to persistent hiring demand. This dynamic supports wage growth and consumer spending power.

Real wage growth turned positive in June-23. Real wage growth turned positive in June 2023, with all employees witnessing a 1.2% YoY increase in real average hourly earnings (as of June-23, seasonally adjusted). These figures are adjusted to remove inflation effects, thus providing a more accurate measure of purchasing power over time.

Fiscal & Monetary Policy

Fiscal policy has turned slightly expansionary in 2023. After facing some headwinds in 2022, government budget deficits are once again widening in 2023 to 4% of GDP (UBS Editorial Team, 2023). The Infrastructure bill, CHIPS Act, and IRA have incentivized business investment, resulting in a 40-year high for manufacturing investment at 0.7% of GDP.

Monetary policy is still accommodative. The Fed's balance sheet stands at $8.5 trillion, which is 80% above pre-pandemic levels (UBS Editorial Team, 2023). While the inversion of the Treasury yield curve indicates market expectations of an eventual recession, monetary policy continues to be stimulative.

Inflation expectations are stabilizing. Consumers foresee 4.3% price increases over the next year, down from a 5.4% forecast in June (EY-Parthenon, 2023). Lower inflation improves household financial outlooks, reducing consumer anxiety about rampant inflation eroding their purchasing power.

Credit markets are functioning well despite Federal Reserve tightening. Corporate bond issuance rose in June and high yield credit spreads narrowed (UBS Editorial Team, 2023).

Business / Markets

Supply chain strains are steadily easing. The global container shipping index has plunged over 65% from its peak in September 2021 as ports decongest (EY-Parthenon, 2023). Lead times for manufacturers have also come down from multi-year highs.

Corporate profits and balance sheets are healthy. 70% of S&P 500 companies exceeded Q1 2022 earnings estimates. Cash reserves approached $2 trillion, providing insulation from credit shocks (UBS Editorial Team, 2023).

Although moderating, housing demand has shown resilience. Monthly new home sales are still 15% above pre-pandemic levels, and up 7% year-on-year, as tight inventories maintain competition (EY-Parthenon, 2023). Median new home prices have also increased by 1.5% YoY (Dale, 2023). Interest among homebuyers has remained stable despite rising mortgage rates.

In summary, with stable household finances, strong corporate profits, and moderating inflation, the economy seems to be weathering the turmoil of rate hikes and regaining its balance. Rick Rieder, BlackRock's Chief Investment Officer of Global Fixed Income, believes the risk of a U.S. recession is overstated. Rieder acknowledges that high inflation can become ingrained in expectations, making it tough to reverse. However, he argues that once inflation approaches 3% policymakers may be less worried. With patience, restrictive rates will gradually bring inflation towards the target (Hajric & Greifeld, 2023).

A key assumption in the recent stock market rally is that the Fed will begin to reduce rates. The cost of options for Fed cuts in late 2024, designed to protect against a credit event or recession, is as low as before the banking crisis. This implies a high level of confidence that a credit event or recession is unlikely in the near future.

🛡️Negative Indicators🛡️

Greg Jensen, Co-Chief Investment Officer from Bridgewater, provided an insightful analysis of the current economic situation. He suggests that the impact of rising interest rates may have been offset by consumers' readiness to use their excess cash reserves amassed during the Covid-19 era. This transfer of money between household and corporate balance sheets has strengthened the economy. Simultaneously, corporations have extended the maturity of their debt, effectively securing lower fixed rates and delaying potential defaults to a later period (Jensen, 2023).

So, what are the risks? Technical factors indicate that risk-on conditions continue, but some warning signs are emerging. Slowing growth, geopolitical unrest, inflation, and monetary tightening could destabilize the recovery. Further supply shocks from COVID waves in China, the Russia-Ukraine war, or adverse weather could impact goods and food costs. Wages could surge rapidly as full employment continues, leading to a wage-price spiral. Lastly, regional banks face growing threats from exposure to distressed commercial real estate loans, which could put them at risk.

Business Risks

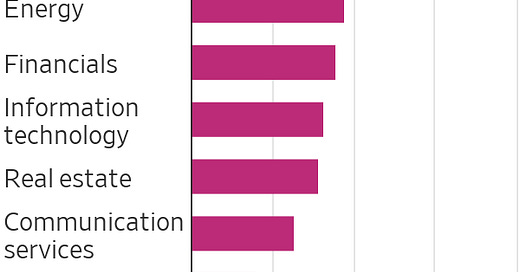

S&P company profits may decrease. Rising wage growth coupled with slowing headline inflation could benefit consumers but squeeze company margins. Profits of S&P 500 are expected to plunge 9% year-over-year, the largest decline since 2020 (Jaisinghani, 2023).

Manufacturing and industrial output are shrinking. The ISM Manufacturing Index entered contractionary territory in June and July. Durable goods orders have fallen for three consecutive months through May (EY-Parthenon, 2023). Production and exports are decelerating.

Inventory accumulation indicates supply-demand imbalances. Inventories grew 1.4% in May while sales dropped 0.3%, possibly hinting at future production cuts (EY-Parthenon, 2023). Retail and wholesale stockpiles are also rising rapidly.

Business investment is set to drop. Nonresidential fixed investment has contracted for two consecutive quarters. Tighter financial conditions and moderating demand encourage caution (EY-Parthenon, 2023).

Macro Risks

The strong dollar is hindering competitiveness. The broad trade-weighted dollar index has appreciated by over 18% since early 2021, exerting pressure on exports (EY-Parthenon, 2023). Inflows from tourism and services have also declined.

Recession signals are flashing in credit markets. The 10-year to 3-month Treasury yield curve has further inverted, while real yields plunged deeper into negative territory in July (Snider & Pal, 2023). Credit spreads have significantly widened as well, with US IG (A-rated) at 5.25% (vs. 2.4% last year) and US HY around 8.1% currently (vs. 3.3% last year) (Slok et al., 2023).

A credit default cycle has commenced. Despite the facade of economic resilience, a default cycle has started, marked by increasing bankruptcy filings, loan defaults, and bond issuer downgrades (Slok, Agarwal, & Shah, 2023). Bankruptcy filings for large companies have increased 36% over the last 12 months. The US speculative grade 12-month trailing bond default rate has risen to 2.8%, up from 1.1% a year ago (Slok et al., 2023).

Fiscal & Monetary Policy

Fiscal and monetary ammunition is depleted. Financial conditions have actually eased as the Fed tightened, indicating diminishing stimulus withdrawal (Lake & Dale, 2022). With swollen deficits and debts, options for stimulus are limited. However, increasing rates amidst an economic contraction risks instability (Lake & Dale, 2022).

Business / Markets

Regional banks face risks from commercial real estate exposure. With high office vacancy rates, heavy concentrations of commercial loans could trigger credit losses (Slok et al., 2023). Deposit runoffs also put pressure on liquidity.

Chinese slowdown spillover risk looms. Strict COVID policies and turmoil in the property sector have drained growth. Chinese developer defaults are proliferating amid 20% bond yields (Slok et al., 2023). This could have spillover effects on the US as China is one of our biggest trade partners.

In summary, although the momentum of post-pandemic recovery should not be underestimated, the majority of data is painting a more somber picture. As growth slows, a policy error could push the economy into a self-reinforcing recession.

Conclusion: At a Critical Juncture

The data presents mixed signals - ongoing labor market strength vs. weakening manufacturing and rising equity values vs. flashing recession signals in credit markets. Portfolio resilience necessitates planning for a range of outcomes - from a Fed-engineered soft landing to a recession.

💼 So how could one position a portfolio to account for all this? 💼

Scenario 1: No Recession:

If you are not anticipating a recession, Rick Rieder of Blackrock advises investing in high-carry, short-duration assets like commercial paper or short-term treasuries. He also recommends having significant exposure to investment-grade credit and equities. His investment suggestions revolve around generating income from high-quality fixed income assets and owning equities for additional upside. He believes these strategies could prove more stable than historical approaches given high rates today (Hajric & Greifeld, 2023).

Scenario 2: Higher Recession Risk (within 12-18 mo. time frame)

If you foresee a recession on the horizon, a defensive stance is prudent. Hugh Hendry suggests that in a $1 million sample portfolio, one could hold $200k in equities, $200k in long-dated Treasuries calls, $200k in Bitcoin, and $500k in cash (Hendry, 2023). Equity allocation focuses on stocks with less cyclical sensitivity like mega-cap tech, Treasury calls provide convexity to benefit from eventual rate cuts by the Fed, and Bitcoin serves as an uncorrelated real asset and provides inflation protection. In addition, cash now earns a decent yield and preserves flexibility to deploy into opportunities (Hendry, 2023).

References

EY-Parthenon. (2023). *Macroeconomic Outlook and Impact on Businesses. Retrieved from https://www.ey.com/en_gl/economics/executive-macroeconomic-briefing-june-2023

Hajric, V., & Greifeld, K. (2023). BlackRock’s Rieder Says US Doesn’t Have to Fall Into Recession. Bloomberg. https://www.bloomberg.com/news/articles/2023-07-15/blackrock-s-rieder-says-there-s-no-need-for-us-to-see-recession

Hendry, Hugh (Guest). (2023, July 14) How to trade recession risk [Transcript]. Retrieved from https://www.realvision.com/shows/buy-side-meets-sell-side/videos/how-to-trade-recession-risk-pqka?tab=details

Jaisinghani, S. (2023). A $10 Trillion Stock Market Rally Faces Crucial Test in Earnings. Bloomberg. https://www.bloomberg.com/news/articles/2023-07-16/a-10-trillion-stock-market-rally-faces-crucial-test-in-earnings

Jensen, Greg, guest. (2023) “Bridgewater’s Greg Jensen on AI, Inflation, and What Markets Are Getting Wrong” Odd Lots, Bloomberg, 3 July 2023. https://podcasts.apple.com/us/podcast/odd-lots/id1056200096?i=1000619106027

Lake, M., & Dale, D. (2022). *Is it time to go risk on?* [Transcript]. RealVision. https://www.realvision.com/shows/the-real-vision-daily-briefing/videos/is-it-time-to-go-risk-on

Pal, R., & Snider, J. (2023, May 29). *Something, Somewhere, Is Going to Break* [Transcript]. RealVision. https://www.realvision.com/rv/channel/realvision/videos/63fb7a0fe29b4e4f8be8b59421d814ab

Slok, T., Agarwal, J., & Shah, R. (2023). *Apollo Credit Market Outlook: High Rates and Slowing Economy Creating Opportunities for Credit Investors.* Apollo Global Management.

UBS Editorial Team. (2023). 10 reasons why there hasn’t been a recession. *UBS*. https://www.ubs.com/us/en/wealth-management/insights/market-news/article.1595261.html

DISCLAIMER

Opinions expressed are solely my own and do not express the views or opinions of my employer.

NO INVESTMENT ADVICE

This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content on the site before making any decisions based on such information or other content.

INVESTMENT RISKS