Weekly Macro Update: Aug 27th, 2024

Fed confirms rate cuts are coming; economy is healthy; Nvidia earnings Wednesday!

Macro Scorecard

If you find this useful, please share it with your friends and colleagues!

What Happened This Past Week?

Monday, August 19: Leading Indicators Index

The LEI fell 0.6% in July to 100.4, following a 0.2% decline in June.

The Conference Board expects real GDP growth to slow, projecting 0.6% annualized in Q3 and 1% in Q4 2024.

Takeaway: The LEI is still negative year-over-year but has bottomed and is moving higher (good sign).

Tuesday, August 20: Fed Speeches

Federal Reserve Bank of Atlanta President Raphael Bostic mentioned that further labor market weakness could lead to more rapid or larger rate cuts.

The size of the first rate cut — a quarter point or a half point — will depend on the data, Bostic said.

Takeaway: Rate cuts are coming, but the size of cuts will be dependent on economic data over the coming weeks.

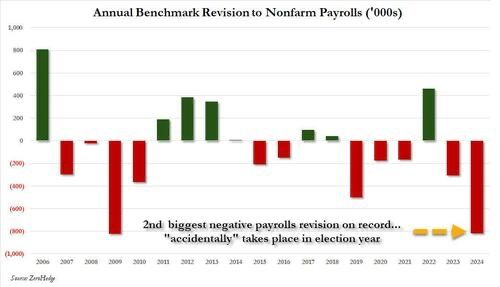

Wednesday, August 21: Non-farm Payrolls Revision

Job numbers were revised down by 818K, the second-largest revision on record.

Average monthly job gains for Spring 2023-2024 were cut to 175K from 242K.

Professional and business services (-385K), leisure and hospitality (-150K), and manufacturing (-115K) saw the largest downward revisions. Transportation, warehousing, and health services saw upward revisions.

Takeaway: The labor market is softer than previously thought, with job growth decelerating faster than initially reported. However, the direction of travel is still up.

Thursday, August 22: Jobless Claims and Flash PMIs

Initial jobless claims averaged 236K since early June, up from 213k in early 2024. Texas and Michigan are largely responsible for recent volatility in claims.

S&P Global Composite PMI decreased to 54.1 in August from 54.3 in July.

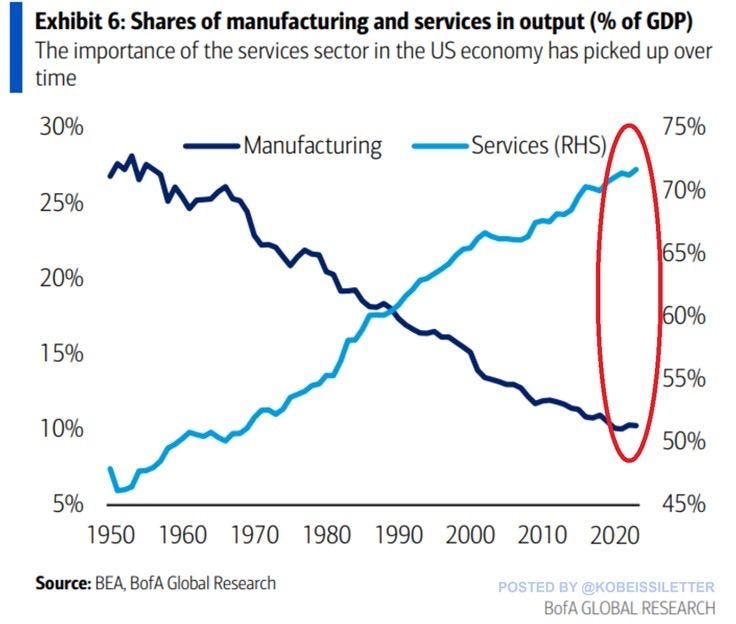

S&P Manufacturing PMI fell to 48 (8-month low), while Services PMI rose to 55.2.

Takeaway: The US economy is now almost entirely driven by the services sector (accounts for ~72% of US GDP, up from ~60% in 1990). The services sector continues to drive economic growth, offsetting weakness in manufacturing.

Friday, August 23: Jerome Powell's Speech

Powell signaled a clear shift towards rate cuts, stating "The time has come for policy to adjust". The Fed now sees both inflation and labor market conditions supporting a less restrictive policy.

Powell noted the Fed "does not seek or welcome further cooling in labor market conditions."

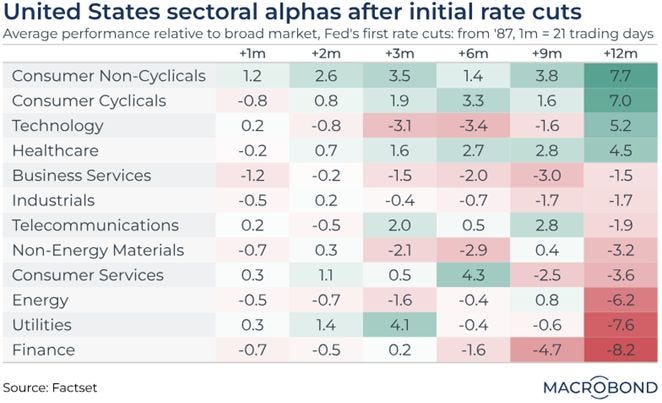

Analysts expect rate cuts to begin at the September 18 FOMC meeting, with four cuts anticipated by year end.

Takeaway: The Fed is pivoting towards a more accommodative stance, with rate cuts likely to begin soon. Sectors that benefit most from rate cuts (historically) include consumer cyclicals, technology, consumer non-cyclicals, and healthcare sectors.

Sentiment

Economic Releases This Week

Tuesday: US Conference Board consumer confidence, S&P home price index

Wednesday: Nvidia earnings

Thursday: US GDP (2nd revision), initial jobless claims

Friday: US personal income, spending, PCE; consumer sentiment