Weekly: October 15th, 2024

We are incrementally worse off this week in economic data; hedges might be prudent

TL;DR

I give an update on the markets and the business cycle (and how my views have changed). Themes covered include growth, inflation, labor, and fiscal / monetary policy.

US Macro Update

We are incrementally worse off this week as compared to the prior week. Positioning is stretched as well. I plan to stay fully invested but might hedge some positions in case there is some election volatility in the weeks ahead.

Growth: On the surface, the U.S. economy appears strong. However, a closer examination reveals signs of deceleration.

Inflation: Core inflation rates exceeding expectations suggest that price pressures remain entrenched in the economy.

Labor: While headline labor market figures suggest robustness, several indicators point to potential weaknesses beneath the surface.

Fiscal / Monetary Policy: Traders agree with the Fed dot plot in 2024 (50 bps of cuts) but are less optimistic than the Fed for 2025 (100 bps of cuts), pricing only a 31% chance of reaching a target rate of 325 - 350 bps by December 2025

US Market Update

In order to establish some continuity from week-to-week, I will start each section with our stance from the prior week (“Prior Assumption”), and then present “New Evidence” of data this week which will lead to an updated position. This will show how my investment stance evolves over time as new evidence comes in.

Growth

Prior Assumption [Oct 4th, 2024]

The U.S. economy shows robust GDP growth and improving fundamentals

New Evidence

On the surface, the U.S. economy appears strong. The second quarter of 2024 recorded an impressive 3.0% annualized GDP growth, and the Atlanta Federal Reserve's GDPNow model forecasts a similar 3.2% growth for the third quarter. However, a closer examination reveals signs of deceleration.

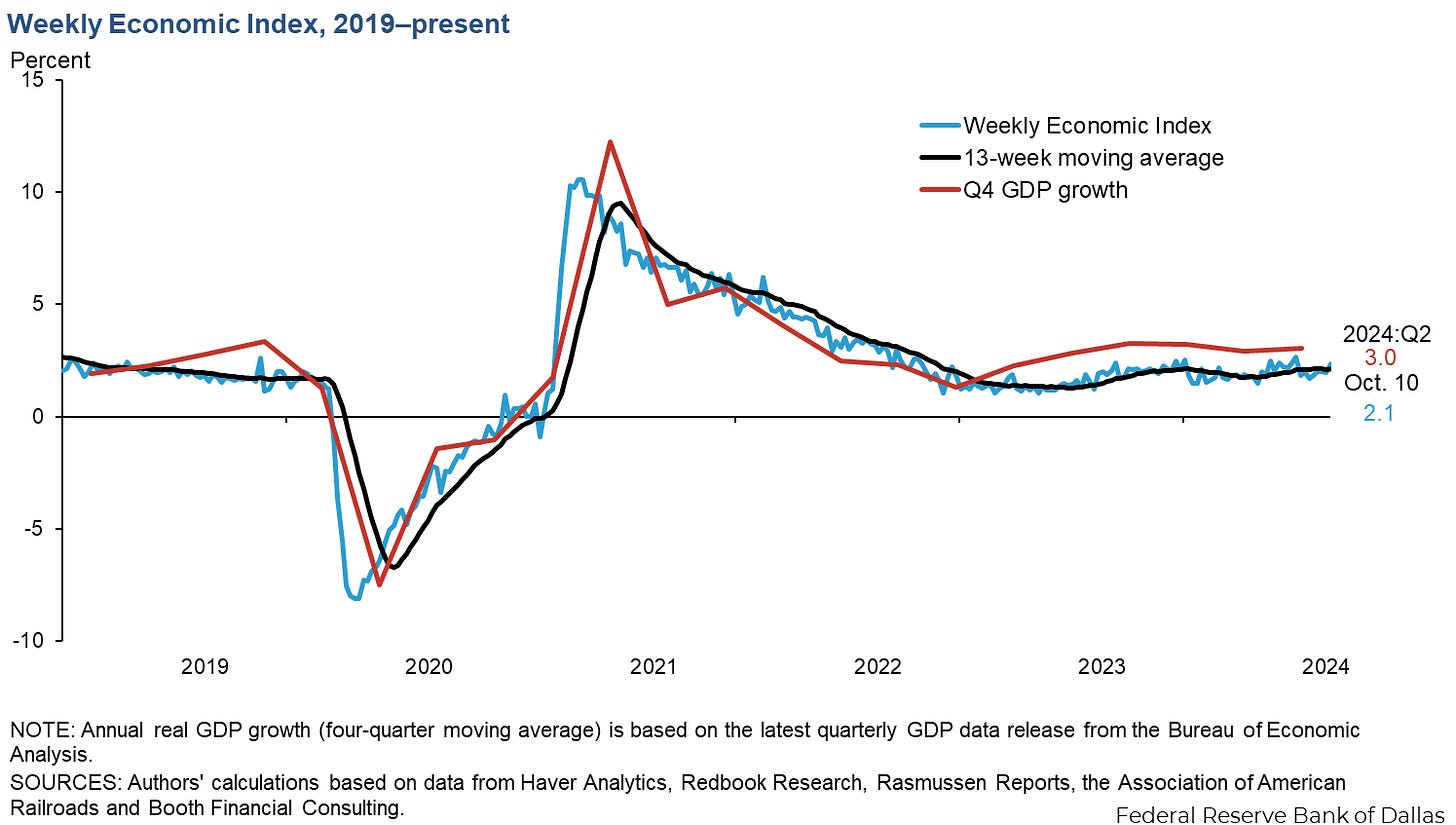

Growth may be decelerating from a high baseline (weekly data)

Federal Reserve Bank of Dallas' Weekly Economic Index indicating a 2.1% GDP growth rate (vs. 3% in Q2 2024)

The services sector continues to be a bright spot in the U.S. economy

ISM Services PMI (Sep 2024): 54.9, up from 51.5 and above consensus 51.7 (Oct 3, 2024)

ISM Services Business Activity Index (Sep 2024): 59.9, up significantly from 53.3 (Oct 3, 2024)

ISM Services New Orders Index (Sep 2024): 59.4, up from 53.0 (Oct 3, 2024)

Hotel occupancy rates, average daily rates, and RevPAR showing strong performance (Apollo, as of latest available data)

The manufacturing sector is still facing headwinds

ISM Manufacturing PMI (Sep 2024): 47.2, unchanged from previous month but below 50 expansion threshold (Oct 1, 2024)

ISM Manufacturing New Orders Index (Sep 2024): 46.1, up from 44.6 (Oct 1, 2024)

Industrial Production MoM (Aug 2024): 0.4%, up from previous 0.2% (latest available data)

Capacity Utilization (Aug 2024): 79.7%, up from 79.5% (latest available data)

Leading economic metrics are degrading

Allianz Global Investors' Macro Breadth Growth Index, which monitors the direction of 354 global, regional, and national economic indicators, has declined for four consecutive months. In August, the index reached a value of -0.6, indicating that more indicators are deteriorating than improving.

The decline in broader economic indicators suggests that the factors propelling earlier growth—such as pent-up demand and government stimulus—may be waning.

High frequency data is still supportive

Redbook same-store sales index reporting year-over-year growth between 5% and 10%

Restaurant bookings consistently exceeding 2019 levels

TSA checkpoint numbers approaching or surpassing pre-pandemic figures

Hotel demand reaching new highs in revenue per available room and average daily rates

Port of Long Beach reporting record container throughput

Inflation

Prior Assumption [Oct 4th, 2024]

While inflation is expected to continue moderating, potential resurgence risks include wage growth (4% YoY) and rising housing costs (+5% YoY).

New Evidence

Core inflation rates are exceeding expectations which suggests that price pressures remain entrenched in the economy. The persistence of elevated shelter inflation, a significant component of overall inflation, indicates that housing costs continue to be a major driver of inflationary pressures.

The economic data suggests that inflation pressures persist

Core CPI remains elevated at 3.3%, up from 3.2% and above consensus 3.2%

CPI YoY for September at 2.4%, down from 2.5% but above consensus 2.3%

Core PPI YoY for September at 2.8%, up from 2.6% and above consensus 2.7%

Michigan 5 Year Inflation Expectations in the United States decreased to 3% in October from 3.1% in September of 2024

Shelter inflation (in blue above) is persisting at approximately 4.8%, contributing significantly to overall inflation.

Allianz's Macro Breadth Inflation Index has also risen for four consecutive months, reaching 0.2 in August, indicating persistent inflationary pressures.

Labor

Prior Assumption [Oct 4th, 2024]

The labor market was incrementally stronger last month

New Evidence

While headline labor market figures suggest robustness—with unemployment at a low 4.1% and an addition of 254,000 jobs in September—several indicators point to potential weaknesses beneath the surface.

Conventional measures like the employment-to-population ratio may not fully capture labor market slack, especially due to undocumented or underreported immigration. Effectively, unemployment might be rising due to an increase in supply of workers (as opposed to layoffs). This influx of workers may be contributing to wage pressures and altering the overall labor market composition.

Labor supply is increasing

The number of individuals working multiple jobs has surged to a record 8.66 million in September. This indicates that many workers are unable to secure adequate full-time employment, relying instead on multiple part-time positions to meet their financial needs.

For the prime working-age group (25-54 years), the employment-to-population ratio remains around 78%, below pre-pandemic levels.

Initial jobless claims have risen, reaching 258,000 in the week ending October 5th, a notable increase from previous weeks.

Labor demand is fine

Layoffs remain at very low levels, with the JOLTS layoffs and discharges rate hovering around 1%.

The job finding rate remains strong, with about 35% of unemployed individuals finding employment each month.

Monetary and Fiscal Policy

Prior Assumption [Oct 4th, 2024]

While the Fed is expected to continue easing financial conditions, futures markets have shifted dramatically on the magnitude of rate cuts this morning.

The U.S.'s ongoing loose fiscal policy may constrain the Fed's ability to cut rates in the future (BlackRock report).

New Evidence

The FOMC dot plot implies a further 50 basis points of easing for the final two meetings of 2024, followed by 100 basis points in 2025.

Traders agree with the Fed in 2024, pricing a ~95% chance of a 25-basis-point cut at the Fed's next meeting and pricing a 84% chance of 2 cuts by year end.

Traders are less optimistic than the Fed for 2025, pricing only a 31% chance of reaching a target rate of 325 - 350 bps by December 2025

The substantial federal deficit and rising debt levels are potentially complicating Federal Reserve's efforts to manage inflation