Weekly: September 16th, 2024

US inflation cooling; Fed might cut 50bps; tight US housing market; China deflation

TL;DR

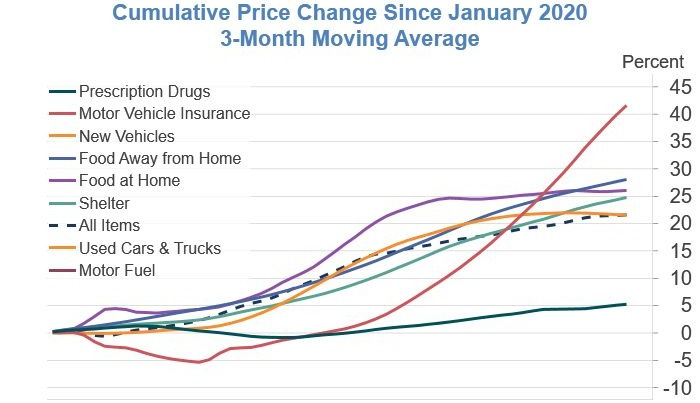

US inflation (CPI) has cooled to 2.6% year-over-year (YoY), the lowest rate in three years. Shelter inflation remains persistently high at 5.2% YoY, accounting for the majority of the month-over-month (MoM) increase in inflation for August. This situation is compounded by the cumulative effects of high inflation on consumers, who are facing price levels that are ~22% higher than during the COVID-19 pandemic.

Core inflation has risen slightly to 3.3% YoY, primarily driven by continued high shelter costs, which have increased by 5.2% annually. The housing market remains under strain due to a significant inventory shortage, with a deficit of 2.3 million homes, which could exacerbate inflationary pressures if shelter costs rise further.

On the monetary policy front, the probability of a 50 basis point Fed rate cut has risen to 59%, up from 14% last week. A cut of this magnitude would lower borrowing costs and stimulate growth in an already robust US economy. I have concerns that the market may be too optimistic, with downside risks to stocks if the Fed agrees to a smaller 25 basis point cut in a few days.

Internationally, China's ongoing deflationary challenges are disrupting global supply chains and affecting US exporters and manufacturers. On a positive note, China's central bank may decide to stimulate the economy to avoid a deflationary trap, which would positively impact global liquidity.

US Market Update

Inflation

US inflation continues to cool, reaching its lowest level in three years at 2.6%. However, shelter inflation remains persistently high at 5.2% YoY, contributing nearly the entire month-over-month (MoM) increase in inflation for August.

The Consumer Price Index (CPI) declined to its lowest level in three years (+2.6% year-over-year). However, the cumulative effects of high inflation are still weighing on consumers (e.g. goods are ~22% more expensive today than during Covid.

Core inflation, excl. food and energy prices, rose to 3.3% YoY (vs. 3.2% in July). This uptick is mainly driven by persistent high shelter costs, which have increased by 5.2% annually and 0.5% month-over-month.

Denys Liutyi in LinkedIn post Shelter costs, the largest contributor to inflation, may rise again. Home prices have reached a median of $430K in 2024, while inventory is at record lows (deficit of 2.3 million homes). See the “Housing” section below for more detail.

Federal Reserve Rate Cuts

The likelihood of a 50 basis point (bps) rate cut, as opposed to a 25 bps reduction, has increased over the past few weeks. A half-point rate cut may provide a more substantial boost to the economy, lowering costs on credit products for consumers and businesses.

Currently, the CME FedWatch indicates a 59% chance of a 50-basis-point cut occurring on Wednesday, a significant increase from the 14% probability reported last week (refer to the chart above).

The Federal Reserve is implementing rate cuts from a position of strength, supported by a strong US economy. This approach may lead to unpredictable economic responses, including increased consumer spending and inflation, without causing widespread job losses.

Housing / Real Estate

The housing market recovery is primarily sustained by a severe shortage in housing supply. Although construction activity is beginning to stabilize, the lag between authorization and completion of new units suggests that supply shortages will persist in the near term.

Supply:

The US faces an estimated housing deficit of 2.3 million homes.

Total housing inventory per capita remains markedly low at 1.09 units per person.

Newly listed homes are significantly below average, with active listings in 2024 persisting below historical norms.

Demand:

More than half of all mortgages outstanding have rates below 4%, and rate cuts might push rates lower over time.

Sentiment remains negative, with 68% of consumers viewing current conditions as unfavorable due to high mortgage rates and tight credit.

Rebounding household formation is a tailwind to housing demand. Demographic shifts, including an aging homebuyer population and smaller household sizes, are increasing housing demand.

Daily and Weekly Indicators

Robust job finding rates, immigration, and sustained wage growth are supporting a healthy labor market. Consumer spending, bank lending, and hotel demand, reflect active economic participation and sustained growth

GDP: Atlanta Fed GDPNow projects a 2.5% GDP growth, slightly higher than the Fed’s weekly GDP index of 2.3%.

Profits: S&P 500 forward profit margins are near record highs, reflecting optimistic corporate earnings outlooks.

Spending: Overall debit card spending shows a steady YoY increase in sectors like Food Services, Health, Personal Care Stores, and Home Furnishings. Automotive is showing some strain, as auto loan delinquencies reached around 8% (highest rate in over ten years).

Labor: Both the Establishment survey and the Household survey show consistent employment growth without signs of deceleration. Average Hourly Earnings is above 6% YoY, surpassing pre-pandemic growth rates.

Credit: Bank lending to firms and consumers is growing (+15% as of 2024), supporting business expansion and consumer financing. Default rates are decreasing, reflecting improved credit stability and reduced financial stress among borrowers. However, increasing delinquencies (~9.1% of credit-card balances) show that some consumers are feeling the pinch.

Watching this Week

China's Economic Challenges are Intensifying Deflationary Pressures

China faces significant deflationary risks that could lead to a negative economic spiral, undermining consumer spending and corporate profitability. The lack of direct stimulus to boost household consumption limits the effectiveness of current economic policies, necessitating structural reforms to shift growth drivers towards domestic demand.

China's bond yields have reached unprecedented lows due to increased demand for government securities amidst economic uncertainties.

The yield on China's 10-year sovereign notes fell to 2.07%, the lowest since records began in 2002.

State banks have been actively selling long-dated bonds in the secondary market, indicating possible PBOC intervention efforts.

The GDP deflator has shown deflation for five consecutive quarters, signaling a broad decline in prices.

Reduced consumer spending has led to lower prices, squeezing corporate profits and potentially leading to wage cuts.

Excess capacity in manufacturing, resulting from inadequate stimulus, is driving down producer prices and complicating export strategies.

China's core Consumer Price Index (CPI) rose only 0.3% in August, indicating subdued price pressures excluding volatile food and energy sectors.

The collapse in the Chinese real estate market has subdued overall economic activity, leading property developers and related sectors to scale back investments.

Fixed asset investment growth slowed to 3.4% year-to-date, exacerbated by disrupted construction projects.

Extreme weather events, including heat waves and torrential rains, are significantly hindering China's economic recovery by disrupting activities.

Industrial production in August likely grew by only 4.5% year-over-year, down from 5.1% in July, marking the fourth consecutive month of slowdown.

Retail sales increased by 2.1% in August, influenced by disrupted travel and consumer spending.

Investment Impact:

China's deflationary pressures signal weakening domestic demand, which may adversely affect global supply chains and demand for US exports. Luckily, as

points out above, the US has become LESS reliant on Chinese imports.Short-Term Impacts (<1 Month):

Consumer Goods and Retail: US companies heavily exposed to Chinese consumer markets might face temporary reductions in sales forecasts.

PBOC Actions: China's state banks are actively selling long-dated bonds, indicating the People's Bank of China (PBOC) may be attempting to stimulate the economy.

Medium-Term Impacts (1-3 Months):

Commodity Prices: Lower demand from China may suppress global commodity prices, affecting US energy and materials stocks.

Supply Chain Disruptions: Ongoing deflation and economic slowdown in China could disrupt supply chains, impacting US manufacturing and technology sectors reliant on Chinese inputs.