2 Reasons Why the Market Is Down Today

$4 Trillion Yen Carry Trade Unwind + Weak Employment (Sahm Rule Triggered)

Financial markets are down today, so wanted to give a quick update to help explain what is going on (in my view - see disclaimer below).

TL;DR:

There are two main factors causing volatility in the market

Currency: Unwind of the Yen Carry Trade

Employment: Sahm rule triggered

What now?

Remember to stay calm even when markets are not. Long-term thesis still holds (US economy is strong), but it might be prudent to raise cash or wait this out until markets give us a confirmation one way or another (not financial advice - see disclaimer below)

Currency: Unwind of Yen Carry Trade

The setup

A currency carry trade is a strategy where investors borrow money in a low-interest rate currency (JPY) and invest it in a higher-yielding currency (USD) or asset (Nasdaq, S&P500), profiting from the interest rate difference while hoping the exchange rate doesn't move against them.

1. Japan had 0% interest rates for about 30 years. Investors borrowed Japanese Yen cheaply and invested it globally (particularly in the US) for better returns.

2. Last week, the Bank of Japan (BOJ) raised interest rates slightly (+0.25%). This made investors worried because borrowing Yen is no longer free and might get more expensive.

The unwind

3. Investors are now selling their investments and buying back Yen to repay their loans. This is causing a rush to buy yen, affecting global markets.

4. The total amount involved in this carry trade is around 4 trillion dollars, which is significant. The unwind is understandably causing some volatility.

The impact

The USDJPY is down ~11% this month (yen strengthened relative to USD) and S&P 500 is down ~7% this month

This is bad, but there was something else that happened last week (Sahm Rule)

Sahm Rule Violation

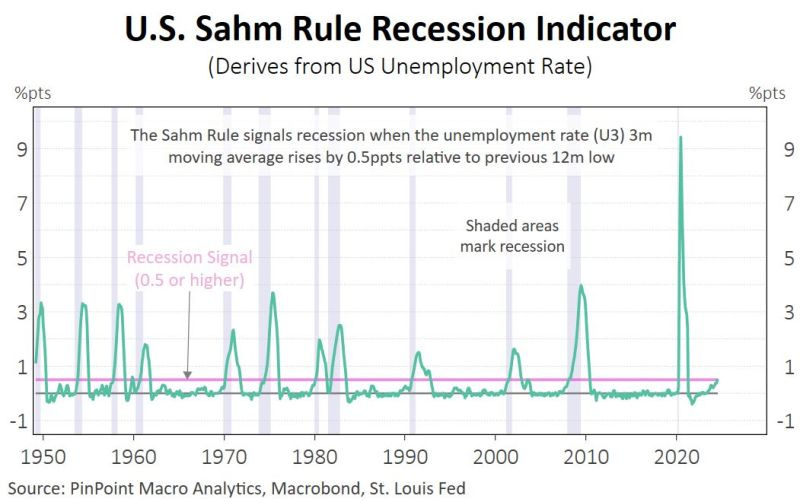

The Sahm Rule is a way to predict possible recessions by via the unemployment rate. While not perfect, this rule has been fairly accurate in the past (see here).

It compares recent unemployment (4.3% as of July) to the lowest rate from the past year (3.4% unemployment rate in early 2023 - a 50 year low).

If unemployment rises by 0.5 percentage points or more above that low point, it suggests a recession might be starting

The Sahm rule was triggered on August 2nd when the BLS released unemployment figures.

Impact on Markets

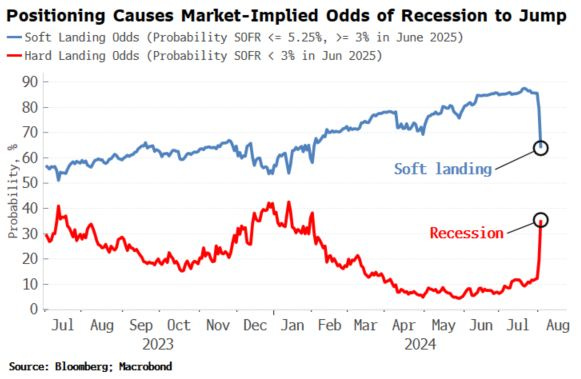

The US economy is still strong (see prior post here), but we expect some volatility ahead. The futures market (source here) is pricing in higher odds of a recession (vs. last week) and substantially more interest rate cuts (see here).

The VIX (market fear gauge) is up

The VIX is a measure that shows how much volatility (big price swings) investors expect in the stock market over the next month. It's often called the "fear gauge" because it tends to go up when investors are worried.

1. Today, the VIX jumped to its highest level in over four years, reaching 65 (it's usually much lower, around 20 or less in calm times). This spike is partially explained by the factors I mentioned above. The last time the VIX was this high was during the early stages of the COVID-19 pandemic in March 2020.

2. While a high VIX often means the market is in trouble, it sometimes peaks and starts to fall off (good sign).

What now?

It's important to remain calm even when markets are volatile. Long-term thesis still holds (US economy is strong), but it might be prudent to raise cash or wait this out until markets give us a confirmation one way or another (not financial advice - see disclaimer below).