The Tech Valuation Bubble

How I Learned to Stop Worrying and Love the Tech Bubble

I would like to explore the recent explosion in valuations for tech companies. I will give my thoughts on 1) catalysts for recent tech stock outperformance relative to cyclical stocks; 2) downside catalysts; and 3) ways to trade in this environment.

The FAANGM stocks now make up almost 27% of the S&P 500 index (first chart below) and contribute significantly to valuation multiple expansion in the index (second chart below). Collectively, the momentum stocks (tech, healthcare, etc.) have taken share from cyclical stocks (industrial, energy, materials) since 2008 and now represent over 55% of the market cap of the S&P 500 index (third chart). According to a BNY Mellon report, a basket of FANG+ stocks (includes the FANG stocks, Alibaba, Baidu, Nvidia, Tesla, and Twitter) is trading at a long-term price-to-earnings (PE) multiple of 83x (as compared to a P/E multiple of 22.2x for the S&P 500 index). Even if these companies collectively achieve 22% earnings growth per year for the next 3-5 years, the stocks would be considered expensive by historical standards.

There are some fundamental reasons for this. Successful tech companies (generally) have healthy balance sheets and strong free cash flow generation. Short term, digitally native tech companies have (and will continue to) take market share because of the COVID-19 crisis as more shopping is done online vs. in-store. Longer term, tech companies will benefit from ongoing structural disruption including the shift to artificial intelligence and increased penetration of electric vehicles. I can’t dispute the claims presented here.

I would counter these claims by saying that the rate of change is more important than the narrative. The tech trade has become more and more crowded. These stocks have benefited from 1) a massive bond bull market that has kept rates low and 2) a pandemic that has crushed their brick-and-mortar competitors. Fiscal stimulus has also enabled consumers to make large purchases digitally (in some cases for the first time). This has reduced customer acquisition costs dramatically for digitally native tech companies. The recent stock price performance of Peloton (exercise equipment) and Wayfair (home furnishings) illustrate this point well. Momentum has pushed these stocks to the stratosphere. Investors are giving them credit for growth and assume the growth will continue at this pace for many years to come.

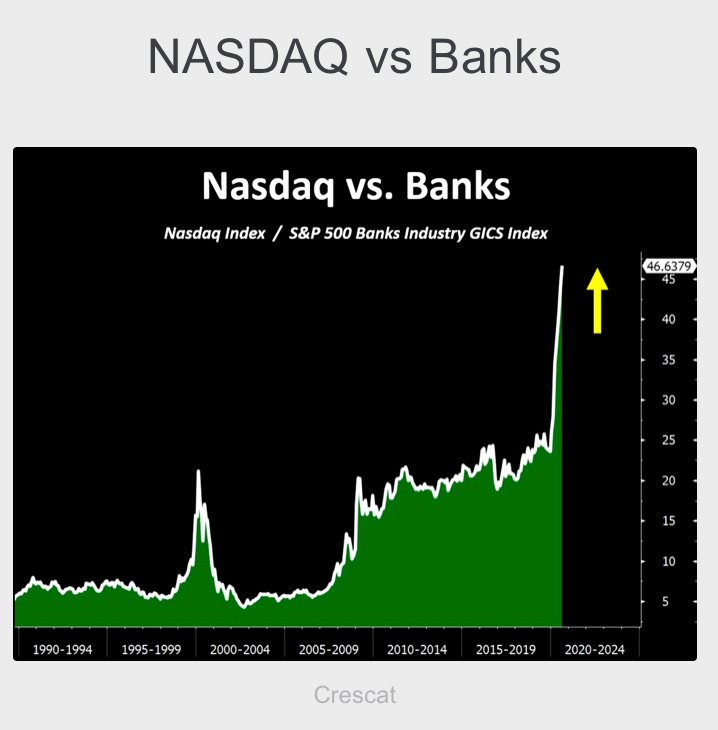

Another example of the speculative bubble in tech stocks can be illustrated by the divergence of tech and bank stock valuations (below).

There are some logical reasons for this divergence. Banks provide loans to automobile manufacturers, real estate companies, and oil refineries. Those sectors are not performing well. The banking industry has lost all of its forward momentum despite having the tremendous advantage of low borrowing costs. Naturally, this has invited competition from tech companies like Monzo (UK-based challenger bank) that have acquired new customers and taken market share from traditional banks. However, these same tech companies are now struggling. Monzo recently said that the disruption resulting from COVID-19 pandemic has led to “significant doubt” about its ability to continue as a going concern (link). They failed to take the money they acquired from customers (in the form of new deposits) and repackage that money into loans for small and medium sized businesses (many of which were struggling due to the pandemic). The moral of the story is that tech companies ultimately serve the “real economy” companies that are most impacted by this crisis (consumer retail, real estate, and oil & gas companies). Tech companies can’t sustain their growth if their end customers continue to struggle.

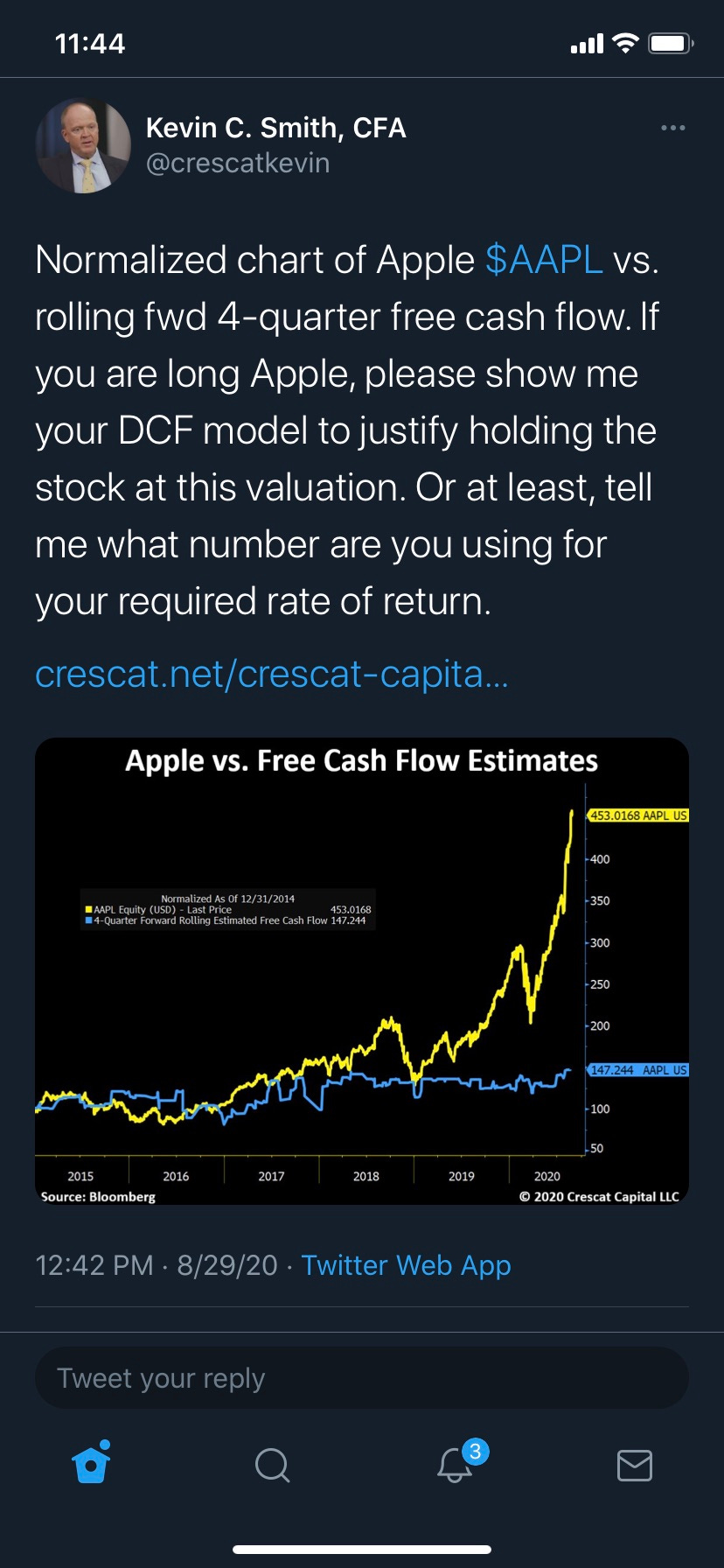

A key critique of this claim is that although tech company valuations are approaching the highs seen in early 2000, the current rally has been supported by strong earnings delivery from these companies. Tech, Consumer Staples, and Pharma were the only three sectors to record positive earnings growth in Q2 ’20. While true, I disagree with the claim that these earnings are sustainable at the current pace (see chart below).

I fear that there are some downside catalysts that might cause these tech stocks to fall back to earth:

Political risk / taxation / anti-trust - It’s hard for people to see their family members get laid off while tech company CEOs benefit from massive stock bonuses (example: Elon Musk is close to being awarded the second tranche of his $55 billion bonus package). Politicians can score easy points by going after the deep pockets (in this case - tech companies and their executive boards). We have already seen this with the recent regulatory hearings on Capitol Hill with the leaders of Facebook, Amazon, and Google. Chamath Palihapitiya summarized this phenomenon in brilliant fashion on his podcast (podcast link). He said politicians are concerned that companies like Facebook and Google have a virtual monopoly on the way consumers search for and access information. Whenever a company corners the lions share of their addressable market universe the government steps in to regulate and tax that company. Higher taxes lead to lower earnings and lower growth for tech companies.

The election - A Biden victory might be negative for the tech sector. The Biden tax plan is focused on increasing tax revenue from tech and healthcare companies that currently pay low marginal tax rates. The potential for a capital gains tax hike -- which, by definition, would hit tech the hardest because the sector has generated the largest gains -- is an additional downside risk. There may be a sharp rotation from tech into cyclical stocks after the election.

A vaccine - I know this one might be controversial. I think a vaccine may come sooner than people expect and this will allow traditional businesses to recover and take market share back from tech companies (e.g. Equinox will steal some customers from Peloton and home furnishings stores may take market share back from Wayfair).

The shift from passive investing to active investing - Passive index funds (ETFs) have very simple buy/sell triggers. If they get inflows of capital from investors they buy stocks. If they experience outflows they sell stocks. That may be an oversimplification, but the point is that these funds buy and sell stocks independent of valuation multiples. If tech stocks are trading at absurdly high valuations, these funds still have to buy them because they comprise almost 30% of the S&P 500 index. But what happens when these passive funds experience net outflows of capital? They have to SELL irrespective of valuation. Who is on the other side of that trade? It could be active fund managers that place greater emphasis on fundamental valuation techniques. If there is a huge spread between an active fund manager’s bid price and the current stock price then the stock can experience 1) very high volatility and 2) a very precipitous decline in value (in some cases well below “fair” value). If you need evidence of this - look at what happened to some of the tech stocks during the market decline in March of this year.

Rising interest rates - Tech valuations are underpinned by a belief that these companies will grow and take share from competitors. As such, their valuations are highly sensitive to interest rate expectations. If interest rates rise, then tech stock prices may fall. I will do a deeper dive on this point in the section below.

Of all of the downside catalysts I mentioned above, I think the prospect of rising interest rates is most concerning for tech stock investors. Rising interest rates (caused by inflation) could disproportionately impact tech companies because their valuations are dependent on cash flows that occur further out in the future. If those cash flows are discounted at a higher rate (e.g. if they become less valuable), then tech stock prices could fall precipitously from their current levels. Bob Prince (Co-Chief Investment Officer for Bridgewater Associates) did a great job explaining why low interest rates have caused a speculative bubble in tech stocks. The full interview (~10 min - link) is very insightful and I would suggest listening if time permits. I found a few sections very insightful that I will jump into below:

When you have a zero interest rate in the treasury bond that means there is no interest rate. If there is no interest rate there's no discount rate on cash flows. So how long is the duration of cash flows? and what's the present value of cash flows that have no discount rate except for the risk premium?

There are a lot of finance words thrown around here (interest rate, discount rate). It may make sense to start with some basic principles before proceeding forward. The intrinsic value of a company can be estimated by taking all the cash flows of a company and discounting them back to the present day using a discount rate. Discounting essentially boils down to assigning a lower value to cash flows that occur in the future (vs. cash flows generated today). If interest rates are higher, then future cash flows are (generally) less valuable. If interest rates are lower, then future cash flows are (generally) more valuable. The other element of the discount rate is the equity risk premium. The equity risk premium refers to the excess return that investors should expect from investing in the stock market. This excess return compensates investors for taking on the relatively higher risk of equity investing (as opposed to investing in treasury bonds).

What does all of this mean for tech company valuations? First, interest rates are near zero in this environment (as measured by the nominal rate on ten-year treasury bonds which stands at 0.726% as of August 31st, 2020). Rates have been kept artificially low by the Fed which has purchased treasury bonds at an alarming rate since March of this year (check out my prior post on this topic). The value of a tech company is MORE dependent upon profits that come much later in time because they are expected to grow. So the discount factor, which is dependent on interest rates, is a big factor in determining tech company valuations. All else equal, lower interest rates should mean higher tech stock prices. The key takeaway is that the current low interest rate environment is GREAT for tech stocks because you can give them more credit for growth (future cash flows) than you otherwise would. The recent increase in the price of Apple stock (yellow line below) is a great example of this phenomenon (divergence between stock price and underlying company cash flows).

But lets look at the corollary to that statement. The prospect of rising interest rates are very dangerous to tech stocks because their valuations are very sensitive to interest rate changes. In other words, you can get a double whammy of valuation multiple compression if interest rates go higher.

From the bond perspective you have virtually zero return. And you have an asymmetric return because there's no limit to how much the bond yield can go up. Even if [rates] goes to zero, you're only going to make 5% or 7% over the next seven years or so. However, you could lose 20 or 30% if you have some sort of a normalization of real yields or a rise in inflation. So you have that asymmetry in the bond market and you're not getting paid any return for the risk you are taking.

Bob Prince is saying that holders of treasury bonds may lose 20% to 30% of their capital if rates go up. The asset that was supposed to give them risk-free returns (treasury bonds) is now providing return-free risk (all risk no returns). Investors that have poured money into tech stocks may suffer the same fate (tech stocks are also highly sensitive to interest rate expectations).

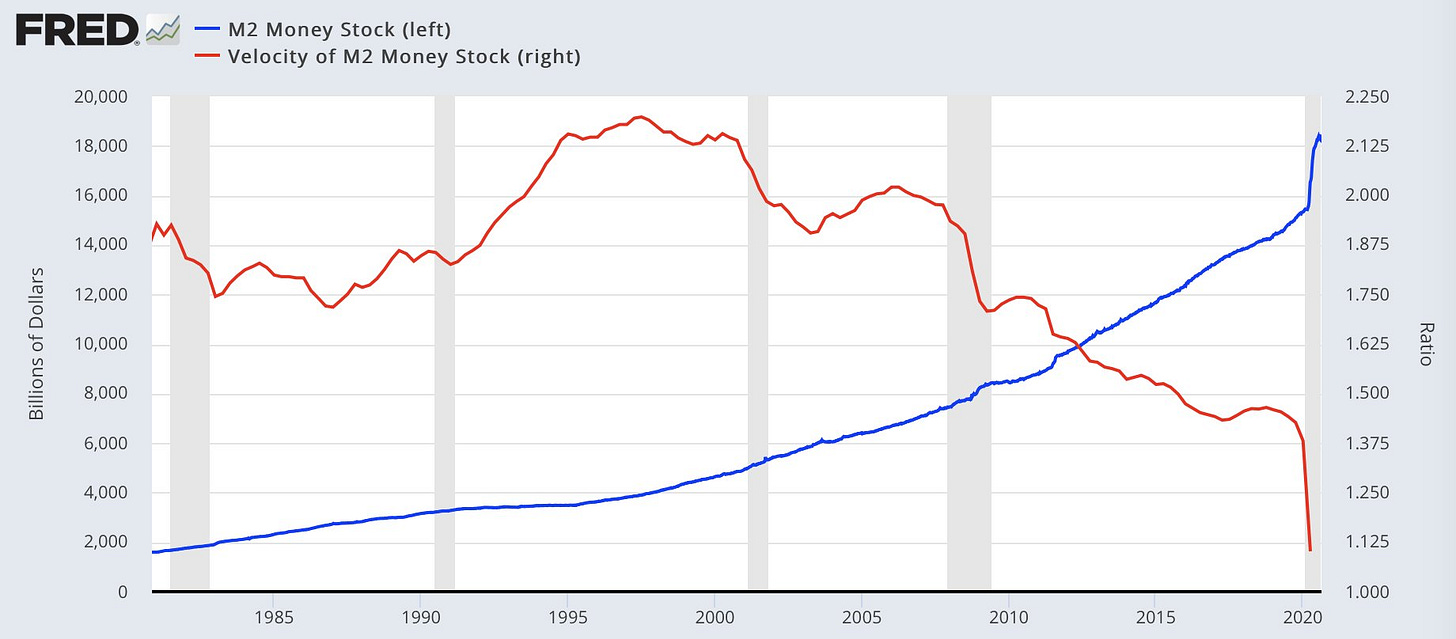

So if the Fed is “printing” so much money why hasn’t inflation gone through the roof? It is due to the divergence between the M2 money supply (blue line below) and the velocity of money (red line below).

The velocity of money is a proxy for the rate of economic activity (lending, investing) in an economy. The speed of money exchange is one of the variables that is used to measure inflation. Simply put, it is the rate at which consumers and businesses collectively spend money. The velocity of money is usually measured as the ratio of gross domestic product (GDP) to M2 money supply. The M2 money supply has increased at an annualized rate of over 30% this year but the velocity of money has cratered to new lows. This shows that banks are hesitant to lend money to consumers and corporations. Money is not changing hands at the rate it used to. If the velocity of money were to increase (either due to looser lending standards or higher confidence in an economic recovery) then the inflation rate may increase. This may put downward pressure on tech stocks.

Conclusion

Okay - we have covered a lot of ground here. By now you may have inferred that I am bearish on tech stocks. But in the investing world, it is not enough to be right about a trend. You can be right about a trend (tech stocks are overvalued and may decline in value) but wrong about the path to that end point (tech stocks have rallied since the March lows and may continue to rally in the near term due to fiscal stimulus). How am I (personally) playing this as an investor?

My portfolio consists of:

20% inflation protected securities (Ticker: LTPZ - a fund of 15+ year US inflation protected securities);

20% equity call options (various companies);

20% long volatility options (Ticker: UVXY - 1.5x leveraged exposure to 1 and 2 month VIX futures);

20% precious metal stocks (Tickers: NUGT, GLD, SLV, etc.); and

20% tech put options with long-dated expirations (mid-2021 and 2022)

I think tech stocks will rally a bit further before correcting (either due to stimulus measures or continued technical support). I don’t think I am smart enough to time the market effectively. However, the payoffs in a market decline scenario (or rotation from tech into cyclical stocks) are favorably skewed to the upside over an 18 - 24 month time horizon (my opinion - not investment advice). I would love to know your thoughts on this!

DISCLAIMER

NO INVESTMENT ADVICE

This content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on this site constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the site constitutes professional and/or financial advice, nor does any information on the site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content on the site before making any decisions based on such information or other content.

INVESTMENT RISKS

There are risks associated with investing in securities. Investing in stocks, bonds, exchange traded funds, mutual funds, and money market funds involve risk of loss. Loss of principal is possible. Some high risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including a greater volatility and political, economic and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Excellent article. Thanks for sharing.

I would also argue the surge in tech stocks (and the stock market in general) is also caused by the excess money supply. I think the CPI is a misleading indicator of inflation -- especially in this day and age. Wealth inequality in this country is real, and majority of excess capital just doesn't get spent on buying consumer goods anymore. It instead goes back into the securities market -- creating further wealth inequality. This is backed up by the fact that the richest 1% of Americans now own more than half of the value of equities. I would even argue the stock market itself could be an indicator for inflation -- not the CPI -- and we are living in a hyperinflation era. Whether that is sustainable or not is to be seen.

Just my humble two cents on the market but would like to further learn from you through this blog. Keep it up.