Weekly: October 24th, 2024

Record bond volatility reveals unease about rate cuts and election volatility

TL;DR

All the major indexes declined yesterday (Oct 23rd), led by the Nasdaq (-1.6%) and S&P 500 (-0.9%). Mixed earnings drove the pullback, with Boeing reporting of a $6.2 billion quarterly loss and McDonald's stock falling 5.1% following an E. coli investigation. These developments reflect broader concerns: weakening American manufacturing, labor issues, and deteriorating regulatory oversight in key industries.

U.S. Treasury yields hit their highest levels since July, with the 10-year reaching 4.24%. The ICE BofA MOVE Index, measuring bond market volatility, hit 129 points, the highest level since January. This volatility reflects market uncertainty over rate cut timing and election outcomes, with second-order concerns about inflation and unsustainable fiscal spending.

Global Economic Outlook

China: China's economic challenges are intensifying with record capital outflows and slowing GDP growth. The positive outcome here for global markets is that the PBOC is injecting liquidity into markets in response to this economic slowdown.

US Outlook

Growth: While consumer spending is resilient (retail sales +0.4% MoM), leading indicators across the manufacturing and housing sectors are deteriorating.

Inflation: Long-term inflation expectations have reached decade highs at 7.1%, even as immediate price pressures show signs of moderation.

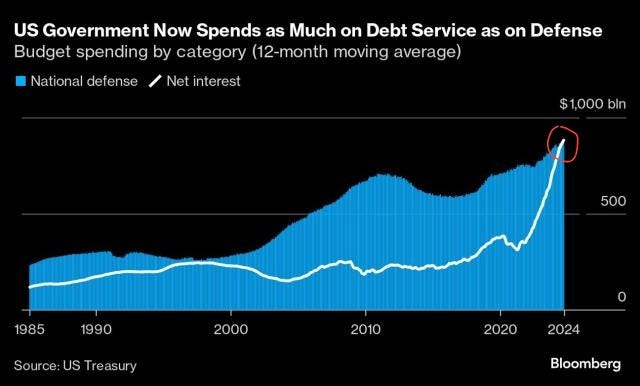

Fiscal Policy: Treasury interest payments have exceeded defense spending for the first time in modern history, increasing anxiety that increased deficit spending may reignite inflation. Neither former President Donald Trump nor Vice President Kamala Harris has made deficit reduction a central element of their campaign.

Monetary Policy: While 71% of major central banks are easing policy, led by the ECB and Bank of England, the Fed may slow down the pace of rate cuts amid U.S. growth and fiscal concerns. Markets now price just two rate cuts (to 425-450bps) through year-end (73% probability).

Global Economic Outlook - China

Prior Assumption [September 16th, 2024]

China faces significant deflationary risks that could lead to a negative economic spiral, undermining consumer spending and corporate profitability. The lack of direct stimulus to boost household consumption limits the effectiveness of current economic policies, necessitating structural reforms to shift growth drivers towards domestic demand.

New Evidence

China’s Economic Challenges = Incremental Liquidity: China’s Q3 GDP grew by 4.6% year-over-year, the slowest pace in six quarters, impacting global demand. In addition to slower GDP growth, China’s debt-to-GDP ratio reached 366% in Q1 2024, indicating rising financial risks. There have been two consequences:

The People’s Bank of China (PBOC) announced measures to support markets, including a re-lending facility for listed companies and major shareholders to buy back shares, in response to economic slowdown and stock market declines.

China faces accelerating capital outflows, with an estimated $254 billion leaving the country illicitly in the four quarters through June. This exodus surpasses the 2015-2016 outflows that previously raised financial stability concerns. The trend reflects waning confidence in China's economic trajectory, particularly as property market is facing challenges.

US Economic Outlook

Growth

Prior Assumption [October 15th, 2024]

Growth: On the surface, the U.S. economy appears strong. However, a closer examination reveals signs of deceleration.

New Evidence

A sequence of deteriorating leading indicators, particularly in housing, suggests the Fed may need to balance inflation concerns against growing economic headwinds.

Consumer Resilience (Mixed): Despite declining consumer sentiment (68.9 from 70.1), retail sales showed remarkable strength with broad-based gains (0.4% overall, 0.5% ex-autos), indicating that consumer spending remains resilient even as confidence wanes.

Labor (Declining): Leading indicators like temporary help employment, hours worked, and the quits rate signal a weakening labor market. Jobless claims remain low due to the lack of significant layoffs in construction and manufacturing sectors, which have a higher propensity to file claims.

Housing (Declining): Existing home sales fell to a seasonally adjusted annual rate of 3.84 million in September, marking the lowest level since October 2010. The 1% monthly decline exceeded economists' forecasts. Other housing metrics show slight declines (permits down 2.9%, starts down 0.5%) as well.

Manufacturing (Declining): The stark contrast between NY Empire State (-11.90) and Philadelphia Fed (10.3) manufacturing indices suggests significant regional disparities in manufacturing activity, pointing to uneven economic growth across different parts of the country. The shift in industrial production from 0.3% growth to -0.3% contraction, combined with falling export prices (-0.7%), indicates mounting pressures on the manufacturing sector

Inflation

Prior Assumption [October 15th, 2024]

Inflation: Core inflation rates exceeding expectations suggest that price pressures remain entrenched in the economy.

New Evidence

U.S. consumers’ inflation expectations for the next 5-10 years skyrocketed to 7.1% in October, the highest since 2011, suggesting that inflation concerns are becoming more entrenched.

Shelter Costs (Declining): The primary sources of inflation, such as housing and durable goods, are showing signs of deflationary pressures. Rising mortgage rates after the Fed's recent cut have dampened buyer activity, with applications declining for four consecutive weeks. This may indicate that housing prices will start to fall (decreasing inflation).

Price Pressures (Declining): The continued decline in both import (-0.4%) and export (-0.7%) prices suggests easing inflationary pressures in the trade sector, though the steady business inventories (0.3%) indicate companies are maintaining stock levels despite economic uncertainty.

Bond Volatility (Increasing): The US ICE BofA MOVE Index, which measures bond market volatility, hit 129 points, the highest level since January. This volatility reflects market uncertainty over rate cut timing and election outcomes, with second-order concerns about inflation and unsustainable fiscal spending.

Fiscal / Monetary Policy

Prior Assumption [October 15th, 2024]

Fiscal Policy: The U.S.'s ongoing loose fiscal policy may constrain the Fed's ability to cut rates in the future (BlackRock report).

Monetary Policy: Traders agree with the Fed dot plot in 2024 (50 bps of cuts) but are less optimistic than the Fed for 2025 (100 bps of cuts), pricing only a 31% chance of reaching a target rate of 325 - 350 bps by December 2025

New Evidence

71% of major central banks are easing monetary policy, with the European Central Bank (ECB) and Bank of England cutting rates as expected. However, the US is an outlier due to its above-average growth and rampant fiscal spending, which is causing inflation fears to re-emerge.

US Fiscal Pressures Mount (Increasing): Treasury's interest burden has reached critical levels. Net interest payments hit $882 billion through September 2024, averaging $2.4 billion daily. This represents 3.06% of GDP, the highest ratio since 1996. More concerning, interest costs now exceed defense spending for the first time in modern history. The weighted average interest rate on outstanding U.S. debt decreased to 3.32% in September, marking the first monthly decline in nearly three years. However, the scale of interest costs continues adding to overall public debt, which approaches $27.7 trillion.

Fewer Interest Rate Cuts Expected in US: Markets are pricing in fewer rate cuts from the Fed in 2024 and 2025. Swap contracts indicate 73% chance of two rate cuts (425-450 bps target) over the November and December meetings, reflecting modest expectations for near-term easing. Atlanta Fed President Raphael Bostic emphasized patience in the USA, suggesting rates may remain higher for longer to ensure inflation is controlled.